The Wall Street Journal reported recently that Internal Revenue Service (IRS) migration data from 2021, the most recent year available, shows an accelerating trend of residents fleeing deep blue states.

As an example, the WSJ cited Illinois, where a net of 105,000 residents exited the state along with roughly $10.9 billion in adjusted gross income.

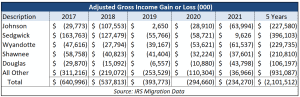

It’s not just blue states losing residents and income, however. Kansas lost $234 million, and the five largest counties have also seen a net loss over the last five years.

Johnson County Commission Chairman Mike Kelly suggested in his first State of the County address that everything in Johnson County is sunshine and roses, but the IRS migration data presents a more troubling picture.

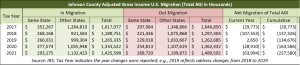

Between 2017 and 2021 Johnson County suffered a net loss of $227.5 million in AGI, having had net losses in four of the last five years. It is also noteworthy that net migration into Johnson County from other parts of Kansas has dramatically slowed over the last five years and it was barely positive in 2022.

Sedgwick County saw a slight uptick in 2021 of about $9.6 million but has a net loss of about $396 million over the five-year period.

Wyandotte, Shawnee, and Douglas counties have had net losses in AGI in each of the last five years, losing $229 million, $210 million, and $106 million respectively.

Indeed, while the loss of AGI is not unique to those five counties — the rest of the state lost a bit over $931 million in the same time period — the combined loss to the tax base of those five counties at approximately $1.2 billion was more than the rest of the state combined.

Kelly cited “reckless spending cuts by past Kansas Legislatures” and said he would continue the “county’s work of doing what the legislature hasn’t in providing for our residents,” but state spending hasn’t been cut; it jumped 43% over the last five years. And like Overland Park and most other cities in Johnson County, the county has significantly increased the property tax burden on residents (more than double the amount needed to offset inflation and population growth.

According to the Shawnee Mission Post, Kelly is pushing for a comprehensive electric vehicle charging network, pushing “sustainability” and “green construction,” and “increase human services for mental health, support for seniors and housing insecurity.” While he said he would “look into ways to leverage federal funds for county programs,” federal funds come with federal strings that sometimes make programs more expensive in the long run. Kelly is already on record wanting another big property tax increase this year.

Chairman Kelly may want to take a closer look at the long-term trends because it is not just the out-migration of AGI that portends trouble. New U.S. Census data shows the Johnson County population increased by just 0.7% in 2022, and that is the second year that population growth has been less than 1%. Prior years had been well above 1% annual growth.

IRS migration data: Low-tax states see a boom from Blue Flight

When taxpayers flee high-tax jurisdictions they generally head for somewhere they get to keep more of their own money.

As the WSJ notes, “the lowest tax states added some $100 billion of income during the pandemic. Zero-income-tax Florida gained $39.2 billion—up from $23.7 billion in 2020 and $17.7 billion in 2019. About $9.8 billion of the total arrived from New York, $3.9 billion from Illinois, $3.7 billion from New Jersey, and $3.5 billion from California.

“Texas was another winner, attracting a net $10.9 billion in 2021, which follows a gain of $6.3 billion in 2020 and $4 billion in 2019. Californians represented more than half of Texas’s income gain in 2021. The Golden State also sent $4.4 billion to Nevada, $2.7 billion to Arizona, and $2 billion to Washington. Nevada and Washington don’t tax wages, and Arizona is phasing out its income tax.”