Johnson County is setting taxpayers up for another big property tax increase in 2024, based on the presentation that county staff will give commissioners at the March 30 “budget retreat.”

The presentation obtained by the Sentinel shows millions in increased revenue, large raises and the desire to hire dozens of new employees. Much of the presentation appears to justify past tax increases and make commissioners feel good about another property tax increase.

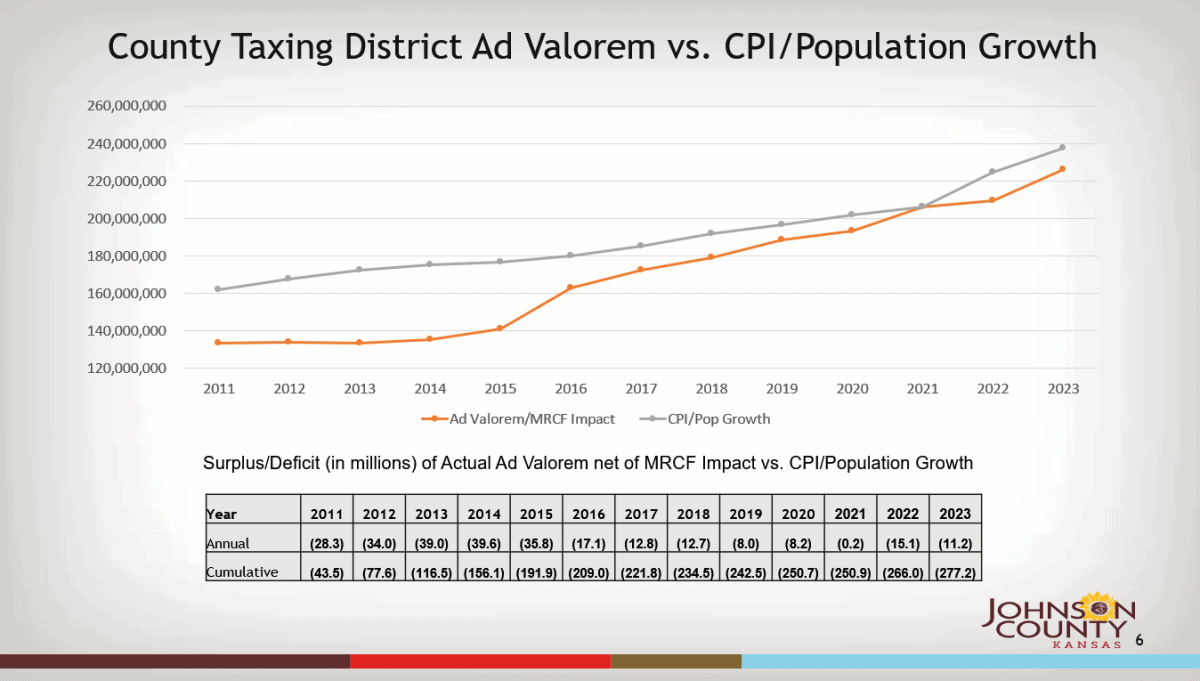

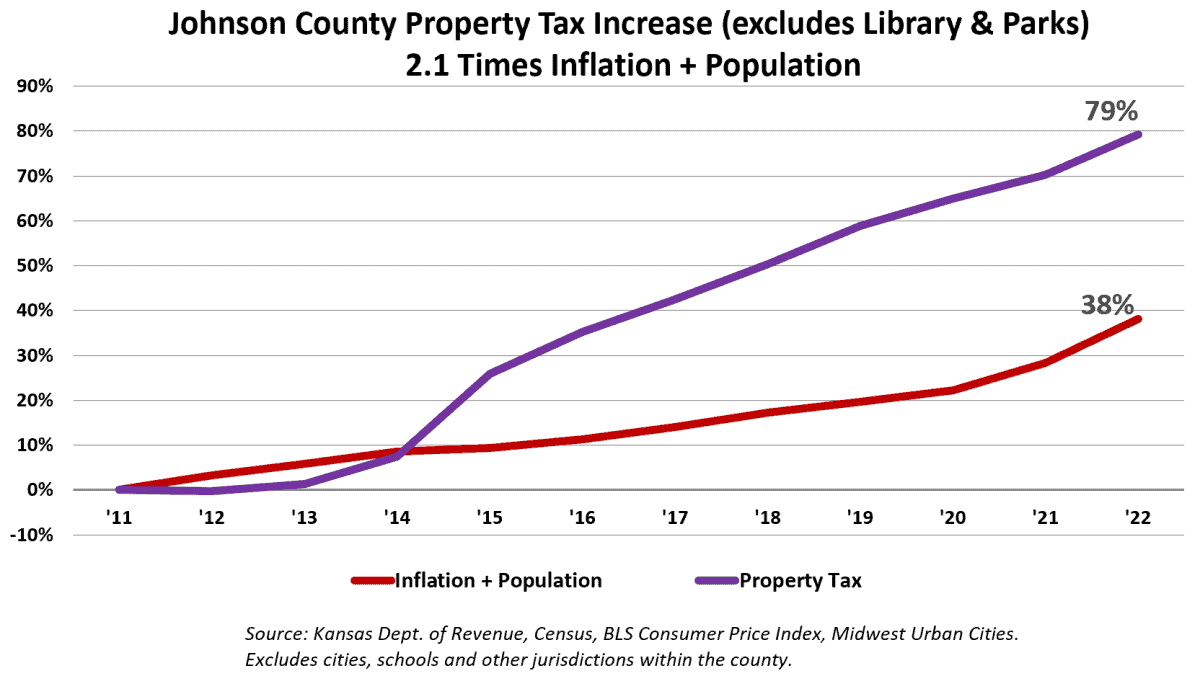

Indeed, in just the sixth slide of the presentation, the staff includes a chart which deceptively indicates property taxes increased slower than the combined increase in inflation and population since 2011. The title of the chart says ‘Ad Valorem’ tax but the data they use is something else. In reality, Johnson County commissioners increased property more than twice as much (79%) as inflation (27%) and population (11%) combined. The real numbers are provided by the Kansas Department of Revenue, the Bureau of Labor Statistics, and the U.S. Census (2022 county estimates haven’t been released, so we assumed the same increase as in 2021).

Slide 19 of the presentation shows a $25 million — roughly 23% — increase in non-property tax general fund revenue between 2022 and the county’s estimate for 2024. Most of that comes from sales tax, use tax, and interest income, which means Johnson County is profiting nicely from inflation and the Federal Reserve’s rate increases.

So instead of using the inflation-driven windfall to give taxpayers a break, county staff wants to spend a lot of it on themselves and new employees. Staff is proposing to spend $21 million to increase employee pay based on compensation study and another $6.6 million — of which $5.3 million would be “tax supported” — on adding an additional 64 “full time equivalent” staff to the county payroll.

So instead of using the inflation-driven windfall to give taxpayers a break, county staff wants to spend a lot of it on themselves and new employees. Staff is proposing to spend $21 million to increase employee pay based on compensation study and another $6.6 million — of which $5.3 million would be “tax supported” — on adding an additional 64 “full time equivalent” staff to the county payroll.

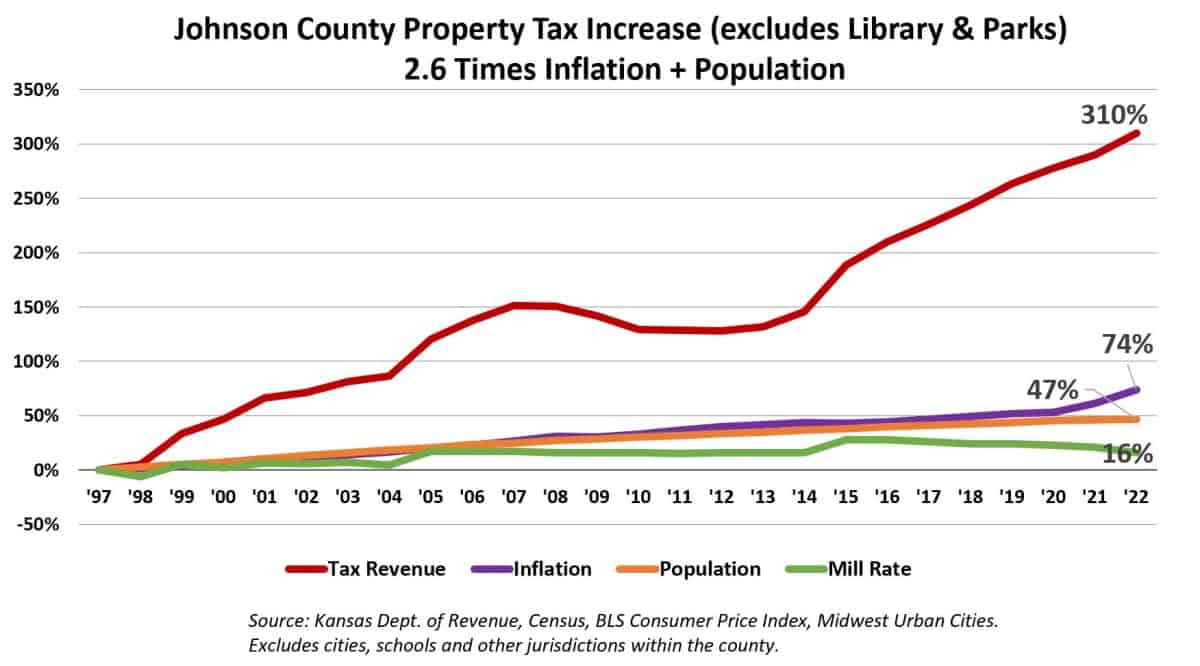

County staff spends a lot of time reviewing prior years’ changes in the mill rate to give the appearing that taxes have not increased. This is a trick governing bodies in Kansas have used for years — keeping the mill levy the same or slightly below the previous year, while increasing taxes based on higher appraised values.

In fact, since 1997, property taxes in Johnson county have jumped an eye watering 310% while inflation and population have lagged far behind — and it would appear the trend will continue in the 2024 budget.