Incentives, also called taxpayer-funded subsidies, are ubiquitous in state and local government economic development efforts. The majority of incentives given to firms to relocate or expand a business typically take the form of cash grants, tax breaks, subsidized borrowing and firm-specific infrastructure projects such as a new building. Kansas is no different. On Tuesday the Wichita City council approved the first round of funding for a new baseball stadium on the sight of the old Laurence Dumont stadium. The $75 million dollar stadium is largely being financed through government subsidies, notably STAR bonds.

This is not the first time that Wichita has dug deep into taxpayers’ pockets for destination developments or corporate relocation. In 2017 Wichita approved about $20 million in incentives for Cargill to relocate its North America Protein Headquarters on the site of the old Wichita Eagle building. The City of Wichita aid is not the only incentive Cargill received though. The incentive package included participation in the Promoting Employment Across Kansas (PEAK) program from the Kansas Department of Commerce. Cargill’s incentive package made news in May 2018 when it was discovered that if the company reduced the number of employees by 100 in 2018, Cargill would qualify for $1.1 million from the state as a rehiring incentive the following year.

The lack of oversight into the PEAK incentives, like the one Cargill received, is the impetus behind HB 2006 being considered in the Kansas legislature. Legislators want to create a database of incentives in the state in order to better track them and ensure firms getting the money follow through on promised job growth. The bill’s sponsor Representative Kristey Williams (R-Augusta) says working with the Department of Commerce and the Department of Revenue disclosed the need to be more transparent about incentives.

“Taking all that experience and realizing we are pretty good at handing out incentives, but we are not so good at measuring them and keeping track of them; making them accessible,” says Williams.

The bill passed out the House unanimously and has cleared the Senate Commerce Committee; it’s uncertain when the full Senate will take it up for debate. Williams notes many legislators realize the need for the transparency and that there were not any real arguments against the bill.

“It’s our responsibility as legislators to be open and transparent and that’s the direction that governments are moved toward on every level,” says Williams.

A key issue that an incentives database would tackle is a legislative post audit that would garner data to allow people to decide if an incentive is really working. Williams says currently there is not really a way for lawmakers to know if a firm or incentive is accomplishing what it said it would.

“We don’t know. We don’t have enough good information. In order to make that judgement you first have to have full disclosure. You shouldn’t have to make an open records request,” says Williams.

Much of the data involving the efficacy of incentives is in the academic sector. A study by Dr. Nathan Jensen with the University of Texas Austin that appeared in the Journal of Public Policy concluded there is no difference between employment creation by firms in the PEAK economic incentive program relative to job creation in firms that did not get PEAK incentives.

Based on a survey of firms that received PEAK benefits, Jensen writes, “Most respondents indicated that the program was efficient, more generous than the program of competing locations and worth recommending to other firms. Despite these clear benefits of the program to individual firms, the majority of respondents indicated that these incentives had no effect on their behavior.”

In an email to the Sentinel Jensen says that incentives tend to go to a small number of firms which are often big companies that have access to capital. For these companies, “having excellent infrastructure and a skilled workforce often tops the lists of priorities for firms,” says Jensen.

Sedgwick County economic growth

A major reason given by governments as to why they give out incentives is economic growth. However, a study by the Upjohn Institute for Employment Research found that firms have literal incentives to claim that the economic advantages handed out by government and economic development groups were vital in relocation or hiring decisions when they may not be.

On the city website Wichita maintains a list of Community Improvement Districts (CID) projects currently undergoing funding, totaling more than $63 million dollars. The CID projects are typically sales taxes collected to pay for construction and development of a property for a third party. The projects are announced with fanfare by elected officials. However, Jensen says a concern about incentives is the political capital it creates for politicians.

“In our book we argue that politicians use these incentives as a way to take credit for firm investments in their region. So a governor or mayor can attend a ribbon cutting ceremony and talk about what the politician did to land the investment,” says Jensen. “In reality, the investment probably came due to infrastructure, physical location, human capital or some other firm specific factor.”

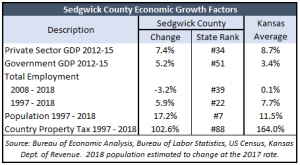

There is no way to track if the millions of dollars spent on projects had a net positive impact (incremental growth beyond that which would have happened without subsidies) on the areas targeted for growth. However, there is economic data for Sedgwick County that speaks to overall growth. Prototype county GDP data published last year by the Bureau of Economic Analysis for the years 2012 through 2015 shows the private sector in Sedwick County grew by 7.4 percent over the period, compared to the state average of 8.7 percent for all counties, giving Sedgwick County the 34th best growth rate among Kansas counties. At the same time government GDP grew by 5.2 percent, which was considerably higher than the overall average of 3.4 percent.

There is no way to track if the millions of dollars spent on projects had a net positive impact (incremental growth beyond that which would have happened without subsidies) on the areas targeted for growth. However, there is economic data for Sedgwick County that speaks to overall growth. Prototype county GDP data published last year by the Bureau of Economic Analysis for the years 2012 through 2015 shows the private sector in Sedwick County grew by 7.4 percent over the period, compared to the state average of 8.7 percent for all counties, giving Sedgwick County the 34th best growth rate among Kansas counties. At the same time government GDP grew by 5.2 percent, which was considerably higher than the overall average of 3.4 percent.

Sedgwick County also trailed the state average in total employment change between 2008 and 2018, declining 3.2 percent and shedding about 7,000 jobs while all counties collectively added about 2,000 jobs and increased by 0.1 percent. Sedwick County added population at a faster pace than the state average since 1997 (17.2 percent vs. 11.5 percent).

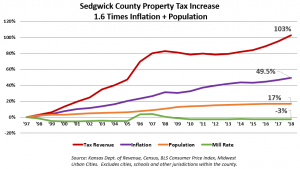

Incentives are also criticized for putting recipients’ competitors at a disadvantage and for growing government; instead of using any incremental tax revenue to reduce rates on all taxpayers, government just spends more. The increase in Sedgwick County property taxes since 1997 seems to bear that out. Property tax just for county operations (excluding cities, schools and other taxing jurisdictions) jumped 103 percent, which is 1.6 times the combined rate of inflation (49.5 percent) and population (16.9 percent).

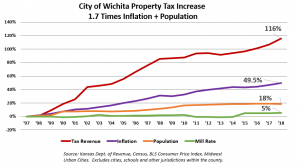

City of Wichita property taxes reflects a similar outsized increase. Property taxes increased 116 percent since 1997, which is 1.7 times the combined rate of inflation and population.

Growth without incentives

Businesses are growing and expanding in Kansas without incentives. In new establishments by state for 2011-2016, Kansas was ranked 2nd nationwide with 15.1% growth; for this purpose, an establishment could be a brand new business or a business that added a new location. Washington was number 1 with 18.2% growth. For business bankruptcies during the same period Kansas ranks 3rd with a decrease in bankruptcies of -31.3%, only New Hampshire and Missouri did better at keeping businesses solvent. Patents issued in Kansas decreased 18% from 2014 to 2017. Trademarks increased by 4% during the same period. There is no way of knowing if this business growth is tied to incentives, which is why Williams feels HB 2006 is needed in Kansas.

“It’s our responsibility as legislators to be open and transparent and that’s the direction that governments are moved toward on every level,” says Jensen.