A parade of city and county officials yesterday asked the House Taxation Committee to delay implementation of the property tax honesty bill from this year to next year, saying they don’t have enough time to prepare to send notices this summer of their intent to raise taxes. Local officials also objected to spending money on software upgrades and postage that they hadn’t budgeted.

The legislation, Senate Bill 13, would require local city and county governments to notify property owners and vote on the entire property tax increase they impose after holding public hearings. It passed the Senate by a vote of 34-1, with implementation set for this year.

The cost of implementation and mailing public notices shouldn’t be excessive but they are unplanned. Then again, taxpayers weren’t planning on local officials imposing economic sanctions on them via COVID shutdowns, curfews, and other limitations; adding insult to injury, cities and counties still expect people to pay their property tax on time without regard to business or job loss.

Asking legislators to give city and county officials a break while blithely ignoring that they don’t want to do the same for taxpayers is sadly nothing new. For example, one excuse routinely given for tax increases (or not wanting to vote on the entire increase they impose) is higher utility costs, insurance costs, and inflation. But taxpayers are dealing with those same issues, plus a tax increase on top.

Delayed implementation would be déjà vu all over again

Examples of local officials not being honest about property tax hikes are plentiful.

Douglas County, for example, writes in their budget book, “Acknowledging that COVID-19 has had a significant economic impact for many, the mill levy remains flat…” But the budget shows a 4.8% property tax increase. It’s pretty brazen to feign concern for ‘a significant economic impact’ while imposing one of their own.

Legislators gave cities and counties a 3-year break on implementing the so-called property tax lid in 2015, which merely gave them three years of unimpeded property tax hikes.

Legislators gave cities and counties a 3-year break on implementing the so-called property tax lid in 2015, which merely gave them three years of unimpeded property tax hikes.

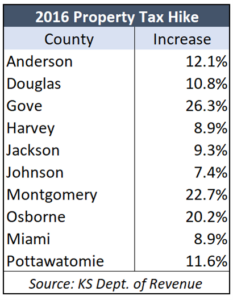

Montgomery County was one of several counties that imposed more than a 20% increase in 2016, raising property tax by 22.7%. Other counties that stuck taxpayers with large increases include (but are certainly not limited to) Douglas (10.8%), Pottawatomie (11.6%), Johnson (7.4%), Harvey and Miami (8.9%), Jackson (9.3%), and Osborne (20.2%).

This is what legislators are inviting if they delay the implementation of the property tax honesty bill.

A solution that meets desire of taxpayers and government

Some legislators might be tempted to grant local officials’ wishes and delay property tax honesty to 2022 because they could also tell taxpayers that they voted for SB 13.

But there is a simple solution that addresses city and county concerns and implements SB 13 this year.

- Give cities and counties the option in 2021 to notify taxpayers with a simple postcard that directs them to a website where they can see how much of a tax increase is being proposed by each taxing jurisdiction in the county, and when the public hearings will be held.

- All other aspects of SB 13 remain in place this year, and the personalized public notice requirement goes into effect in 2022.

Some cities and counties got so much federal COVID aid that they had trouble spending it all, so they surely can find a few bucks in their budgets to send a postcard to every taxpayer. But if they can’t, this recovering accountant will personally volunteer to help them find it.

Property tax honesty is long overdue. Taxpayers are told local officials are ‘holding the line’ on tax increases while having to write a bigger check each year. If legislators don’t force property tax honesty into place this year, taxpayers will be given more ‘holding the line’ claims along with another big tax hike.

Ask your local officials and state legislators this simple question: why shouldn’t local officials have to be honest this year about the full amount of property tax increases they impose?