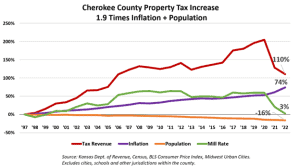

While many local government entities have steadily increased property tax, Cherokee County has reduced property tax revenue for two straight years. And commissioners accomplished this while maintaining service levels.

Since 2020 the Cherokee County mill levy has fallen from 51.604 mills to 39.027 in 2021 and to 33.204 in 2022. One mill is equal to $1 per $1,000 of assessed value. At the same time, property tax revenue likewise dropped from $9.4 million to $6.5 million.

According to Cherokee County Commissioner Lorie Johnson, there were several reasons behind the tax breaks the county has been able to provide.

A significant part of the savings, she said, have been in insurance costs. Cherokee County, like a lot of counties in the state, is self-insured, which means much of the costs of claims are borne by the county itself, rather than an insurance company. This is often a more cost-effective method for local governments, but does sometimes come with unexpectedly high costs.

“The first year that I was in office, our insurance costs went down by about a million dollars because we had several high claimants that retired,” Johnson said. “That was part of it.”

Another significant savings was tied into both regular personnel costs and insurance.

“Cody Zook, our new county lot supervisor, learned that it was better to pay people a better salary and kind of set the bar on your expectations and do more with less,” Johnson said.

So rather than simply replace any employee who left, particularly those who retired, Zook gave the remaining employees raises and “kind of set the bar a little higher,” on job duties.

“So we significantly decreased our number of employees and the insurance cost,” Johnson said.

Additionally, in the last few years Cherokee County, rather than paying the entire cost of insurance for employees has required them — as is generally done in the private sector — to cover part of the cost, another significant savings to the taxpayer.

Doing more with less in Cherokee County

Commissioners have been proactive in working with other departments to look for efficiencies during the budget process.

“All of the department heads have said this is the first commission collectively, in a long time, where all three commissioners sit down and go through the budgets, see what we can do, you know, a little bit more efficiently,” Johnson said.

That translates to routinely shopping for insurance providers — something that was not done regularly in the past — but to look for other efficiencies in personnel hiring practices and shopping for supplies or vehicles.

The commission also took a look at the county ambulance service, noted that the majority of people who needed the service came from out of the county, and shifted the funding from property taxes to sales taxes, meaning the people most likely to actually need the service were also the ones paying for it.

“We put that on the ballot a couple of years ago,” Johnson said. “For the simple reason that the majority of people who were served by ambulance services were from out of town and out of county, you know, people who had a wreck passing through that sort of thing.

“I just feel like we’ve just done a pretty good job of, collectively all the department heads, the elected officials, the appointed people, the commission, just working together to do more with less,” she said.

A perfect example, Johnson said, is the difference in road budget between Johnson County and Cherokee County.

She says Cherokee County has approximately 1,300 miles of roads to maintain and a $3 million budget. Johnson County budget and public works officials tell the Sentinel that the county has a $5.4 million budget to maintain about 400 miles.