The ¼ cent sales tax that was pitched to Finney County voters isn’t living up to its promised “property tax stabilization” but city and county officials want it renewed on August 3 for another 15 years. The sales tax was initially approved in 1995 and has twice been extended.

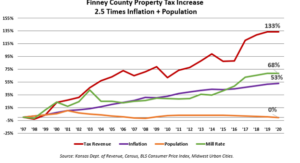

Since 1997, Finney County Commissioners have increased property taxes by 133%, according to the Kansas Department of Revenue. Inflation was 53% over the period and the population is flat, so the 133% increase is 2.5 times greater than the combination of inflation and population.

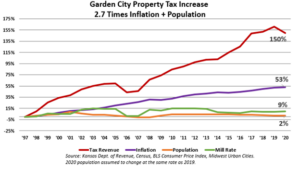

The results are similar in Garden City. The 150% property tax increase is 2.7 times greater than the combination of inflation and population.

Finney County says the ¼ cent sales tax generates a little over $2 million annually. The County and Garden City each get about $1 million and the City of Holcomb gets $85,000.

Local officials say the sales tax is used for infrastructure, but the money received by Finney County and Garden City could be found by operating a little more efficiently.

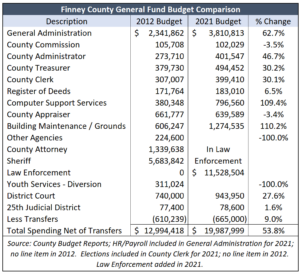

Finney County General Fund spending jumped 54% since 2012

Total budgeted spending in Finney County jumped 49% between 2012 and 2021. Inflation is about 12% over the period (based on 2011 to 2020). Adjusted General Fund spending is almost a 54% increase.

The adjacent table shows the adjusted General Fund budgets for 2012 and 2021. Two items listed separately in 2012 were moved into General Administration to account for reporting changes. Law enforcement form 2012 is now in another fund but we include it for comparison to the Sheriff and District Attorney General Fund budget in 2012. A few other adjustments are listed in the source note. County Administrator Robert Reece said these adjustments present a “reasonably close” comparison.

The adjacent table shows the adjusted General Fund budgets for 2012 and 2021. Two items listed separately in 2012 were moved into General Administration to account for reporting changes. Law enforcement form 2012 is now in another fund but we include it for comparison to the Sheriff and District Attorney General Fund budget in 2012. A few other adjustments are listed in the source note. County Administrator Robert Reece said these adjustments present a “reasonably close” comparison.

General Administration jumped 63% to $3.8 million. Other large increases include County Administrator (47%), County Treasurer (30%), County Clerk (30%), Computer Support Services (109%), and Building Maintenance/Grounds (110%). Law Enforcement is 64% higher than Sheriff and District Court combined.

Garden City General Fund jumps 45%

Total spending for Garden City is up 56% and the General Fund budget is 45% higher.

Engineering, Inspection, and Workers Compensation costs are not shown separately in the 2021 General Fund budget. Most line items have large increases, including General Administration (46%), Police (58%), Development (386%), Parks (60%), and 46% for the Fire Department.

Performance-Based Budgeting identifies efficiencies

Most state and local governments use an appropriation process to build their budgets (Dept. A was budgeted $1 million this year and is requesting more next year).

Done properly, a robust Performance-Based Budgeting process identifies operating efficiencies and ensures spending is allocated in accordance with the prioritization of each department.

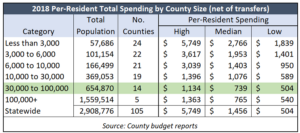

Efficiencies can also be identified by benchmarking against similarly sized counties. A 2018 county spending study from the Center for Entrepreneurial Government at Kansas Policy Institute found very large differences in per-resident spending. (The Sentinel is owned by KPI.)

Finney County, with about 37,000 residents, spent $1,134 per resident in 2018. That’s the highest spending level of all counties in the 30,000 to 100,000 category. Cowley County, with about 36,000 residents, spent the least at $504 per resident.

Finney County, with about 37,000 residents, spent $1,134 per resident in 2018. That’s the highest spending level of all counties in the 30,000 to 100,000 category. Cowley County, with about 36,000 residents, spent the least at $504 per resident.

By operating $50 per resident less, Finney County would save about $1.8 million. That is almost twice the revenue generated by ¼ cent sales tax, and Finney County would still be the highest spender in the category.

Providing the same or better quality service at a better price allows taxes to be reduced, and that is perhaps the best way that government can stimulate the economy.