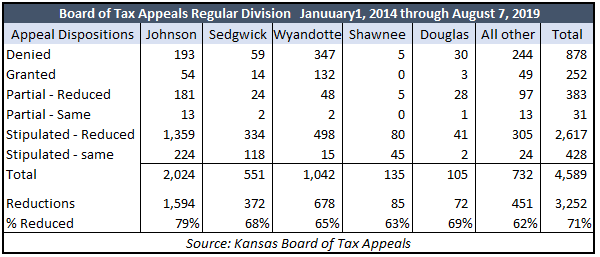

Many Kansans believe their property is overvalued by the county assessor, and the results of property tax appeals before the regular division of the Board of Tax Appeals (BOTA) supports their concern. The Sentinel’s Open Records request for disposition of each case before BOTA’s regular division since 2014 shows a remarkable 71% resulted in property values being reduced.

Of the 4,589 cases over the last 5 and a half years, 3,252 decisions were labeled granted, partially granted with reduced value, or stipulated agreements with reduced value.

The Johnson County assessor’s office by far has the worst record among the state’s five biggest counties, with 79% of property tax appeals resulting in reduced values. Johnson County also has a disproportionate share of total cases, with 44% of the total. The state average without Johnson County is 64% of cases being resolved in favor of the property owner. Douglas County (69%), Sedgwick County (68%) and Wyandotte County (65%) were above the non-Johnson County average and Shawnee County was slightly below it at 63%.

Only 13% of the property tax appeals were granted in full or in part; the majority of the reductions are stipulated agreements. Some property owners who wish to remain anonymous (fearful of higher assessments) say the stipulated agreements amount to an expensive game of chicken perpetrated by county assessors; after spending thousands of dollars hiring attorneys and private appraisers to make their case, counties agree to settle shortly before going to the formal BOTA hearing.

BOTA says a stipulation agreement is when “a draft stipulation is signed by all parties, when both parties agree on a valuation amount and submitted to the Board.” Since 2014 stipulated cases collectively reduced valuations by $1.8 billion, or 16% of the appealed valuations.

Tax attorney Linda Terrill was surprised by the high percentage of reduced valuations by the Board of Tax Appeals.

“At best if you have a really good system, a 1/3 of the values should be high, a 1/3 of them are right and a 1/3 are low,” said Terrill. “That’s a high percentage to me.”

The process of appealing property taxes is not simple and can even result in a higher valuation for property owners. Terrill says it’s not for taxpayers to risk having the value of their property increased during an appeal, and that that also discourages appeals.

“I don’t think anyone should run a risk of having their value increase if all they are trying to do is protest their taxes and try to figure what the value of their property is.”

Terrill says the responsibility for county assessors during the initial appeal meeting is to explain how they arrived at their valuation, but that’s not what they do in practice. Terrill says, “The county is supposed to begin by producing an explanation of how they value your property. I can say that’s not how 99% of all informal hearings begin. They begin with ‘well, what do you think the value of your property should be.’ I tell my clients to insist they start the discussion with how the county values your property.”

How taxpayers can better appeal their tax bill is one issue, but on the other hand it could be better for Kansans if property taxes better reflected a properties actual value and use. 71% of Kansans getting or negotiating lower tax bills on appeal illustrates how poorly or ineffectively taxes are being levied at the county level.

Kansas state senator Caryn Tyson, who also chairs the Senate Assessment and Taxation Committee, says property taxes are the number one tax issue she hears from constituents, and that’s why property tax reform is a priority.

“We are doing a deep dive on property taxes,” says Tyson. “I’ve been spending a lot of my time working on this issue. Our objective is to try and improve the process and try to make it a fair and equitable tax policy for all Kansans.”

Tyson feels that voters focus on property taxes and are more aware of the cost because taxpayers do not cut single checks for sales tax or income tax due to withholding.

“If we look at how much we are being taxed, I don’t think the founding fathers would have ever expected us to be paying more than 50% in some cases 60% of our income in taxes if you count federal, state, and local taxes,” said Tyson.

The property tax appeals in the regular division of BOTA do not include the small claims division, although some small claims cases may have been appealed to the regular division.