Data provided by the Kansas Public Employees Retirement System shows that Kansas has 4,375 KPERS ‘millionaires’—state and local government retirees who will collect at least $1 million in pension benefits over their first 20 years of retirement. That is an increase of 597 over last year. The complete list of KPERS ‘millionaires’ can be found at KansasOpenGov.org.

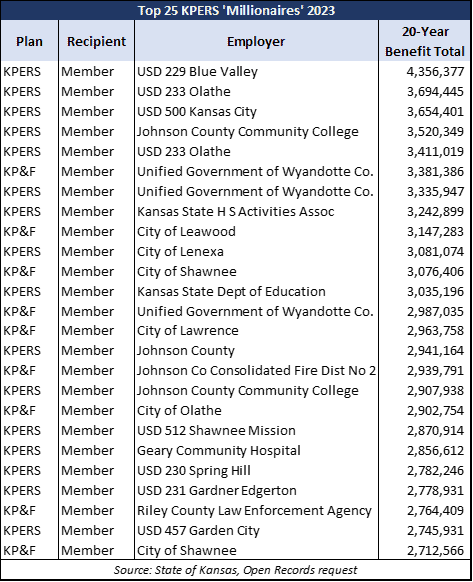

Education officials top the list of the 25 highest payouts, with the first five positions and 12 total slots. Eight retired from local school districts, two from Johnson County Community College, and one each from the high school athletic association and the Department of Education. Six of the top 25 retired from cities, and seven are from county employment.

Education officials top the list of the 25 highest payouts, with the first five positions and 12 total slots. Eight retired from local school districts, two from Johnson County Community College, and one each from the high school athletic association and the Department of Education. Six of the top 25 retired from cities, and seven are from county employment.

State law prohibits KPERS from releasing names, but it’s a pretty safe bet that the first four on the list are superintendents because they are the highest paid. Pensions are based on a final average salary over the previous few years and years of service.

The superintendent at the top of the list, who will collect $4.4 million in the first 20 years of retirement, is probably Tom Trigg. He ‘retired’ from Blue Valley in 2015 and has since been superintendent in Highland Park, Texas. His annual pension from Kansas is $217,819.

The second and fifth slots come from the Olathe school district, most likely superintendents John Allison and Marlin Berry. The third-highest 20-year payout probably goes to Cynthia Lane of USD 500 Kansas City. A retiree from Johnson County Community College is the fourth-highest.

Local units of government (cities, counties, fire districts, etc.) have 2,148 KPERS ‘millionaires,’ followed by public school employees with 1,304 and 717 ‘KPERS ‘millionaires’ from state agencies. The balance comes from community colleges.

Retirees can elect to take a one-time distribution upon retirement, which reduces their monthly benefits. The average pension for a retiree with at least 25 years of service and who didn’t take a lump sum distribution is $65,780.

Kansas government retirees get an extra benefit in not having to pay state income tax on their pensions. They pay income tax on their own contributions, but they are never taxed on the contributions from taxpayers.