Not only has the Wayfair decision heavily impacted small e-commerce sites but it’s also threatening an entire industry, with catalog retailers possibly facing extinction thanks to compliance costs.

Hamilton Davison, president and executive director of the American Catalog Mailers Association said earlier this month he got a call from a 105-year-old family business in Arizona with a seasonally-adjusted workforce of 100 full-time-equivalent employees, say it will be closing down — and it’s the fourth member-company either closing or expected to do so.

He said the problem is, the Wayfair Decision — which allowed states to collect sales taxes from internet and catalog sales — was billed by the states suing as a way to create parity for brick-and-mortar stores, but that’s not what happened.

For big companies, he said, complying with the various state laws is “painful and expensive but not at all fatal.”

However, the smaller the company, the more painful it becomes.

“If you’re under a billion dollars, this is really, really a challenge and the smaller you are bigger the challenge that it is,” he said. “If you’re under $500 million in sales … if you’re under $200 million, this is potentially fatal for you — and as we know, small and medium-sized businesses are the backbone of employment in America.”

The chaos in the wake of Wayfair has led to a situation in which remote retailers are required to comply with state laws that are incredibly fluid.

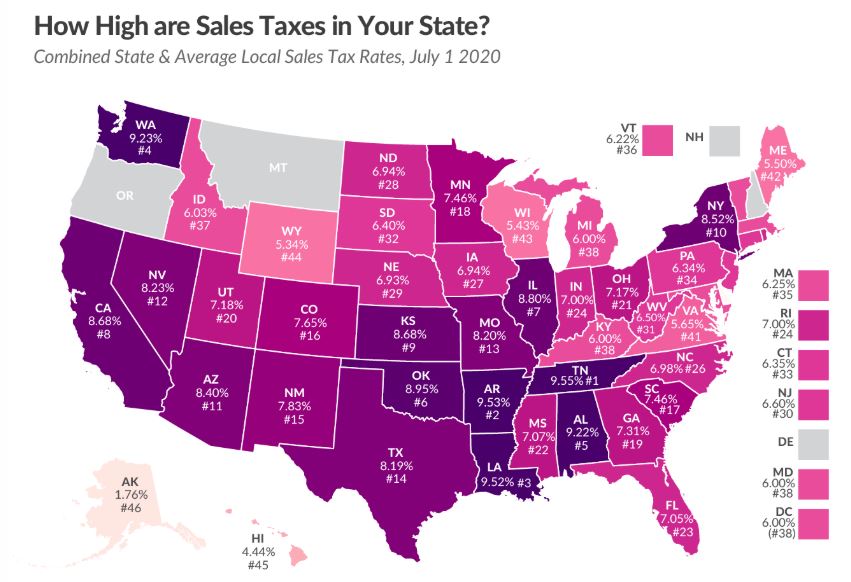

“This is an emerging and evolving issue, which is one of the reasons it’s so hard and we’ve got over 12,000 different taxing jurisdictions in the United States,” Davison said. “Many of them are changing their laws, or there seem to be laws being changed every week. Just staying on top of it is a challenge, much less complying with it.”

And as Bradley Scott, whose wife is the president of their family-owned wholesale jewelry company Halstead Beads in Prescott, Arizona, told the Sentinel, sales tax debts are not dischargeable in bankruptcy — states can seize business assets, and if those are insufficient to cover the “debt,” they can then seize homes, cars, retirement accounts or even children’s college savings accounts.

In fact, Scott said, two states have tried to either put a lien against his wife’s business or seize it outright over mistakes made by the software.

“Tennessee and Wyoming have threatened us with seizures and legal action due to TaxCloud (software) sales tax errors that took 5 months to resolve,” Scott said in a document given to the Sentinel. “The amounts in questions were less than $100 combined.”

Linda Lester, of K-Log, a small school and office furniture company in Illinois — which primarily sells to public agencies — noted that post Wayfair, they are spending tens of thousands of dollars to collect very little tax.

“Ninety percent of our customers are tax exempt schools and government agencies. However, since most states have passed economic laws with thresholds measured in gross sales, not taxable sales, we are required to comply even though little or no tax dollars are being remitted,” she said. “In Illinois, our average monthly tax remittance for the past 30 years has been approximately $200. Outside of states such as California or Arizona, where very few entities are exempt from sales taxes, we will collect similarly small amounts.”

Davison said the issue is one of fundamental fairness.

“This is not parity,” he said. “We’re all for parity. Everybody plays by the same rules on the same day, that would be great.

“This is disparity. If you’re a retailer, a brick and mortar retailer, and you put a store down, you have origin taxing rules to comply within the location of your store, if you’re a 500 store retailer and you put 500 stores down you have 500 different taxing jurisdictions to be concerned with and comply with.

“If you’re a remote seller, you have over 12,000 jurisdictions to comply with. So again, this is not parity, it’s disparity. And it has the potential to significantly reduce the number of remote merchants.”

And, Davison said, the loss of remote sellers is going to primarily impact two types of customers: rural Americans, such as most Kansans — and the elderly or infirm.

Small-town customers cannot always simply nip down to the store to pick up what they need and the elderly often physically cannot, even if a store is relatively close.

“So this has broad-reaching implications for consumers or employers, and therefore employees,” Davison said.

Additionally, he notes that the tax collections may be a net loss for the states; as businesses go under, states will collect less income tax and unemployment taxes and they will spend more on costs associated with administering the remote sales tax.

“I do believe that this is going to have some offsetting reductions in employment taxes, employment levels, and the net to state coffers may be not nearly as great, Davison said. “In fact, may be a wash or even down slightly when when all the dust settles.”

Lobbyists like Davison have gone to both the states and the federal government with complaints but have had them dismissed.

“When I talked to one state official, I said ‘you’re a CPA.’ ‘Yes, sir. I am.’ ‘You’re a business owner.’ ‘Yes.’ ‘You’re an entrepreneur.’ ‘Yes, sir.’ ‘You’re also a state senator.’ ‘Yes, sir. I am.’ ‘And you understand how disruptive this is?’ ‘Yes, I do.’ ‘Why are you doing this to us?’ ‘Because you don’t vote for me.’

“Politicians love to tax people that have no standing, no ability to make them pay the consequences,” Davison said. “Departments of revenue are released from our conversation with them are largely indifferent to all of these issues and concerns.”

Worse, when Davison and his colleagues argue on Capitol Hill that this is destroying industries they’re told if the problem is as bad as they say, there would be litigation.

“When I’m on the Hill talking about what a tragedy this is they say, ‘where’s the litigation? If this is as bad as you say, there’s going to be litigation all over the place. We don’t see any litigation. There’s no problem here.'”

Unfortunately, the small retailers who are most impacted by Wayfair have the least resources to fight.

“This does not end well unless people step up and follow a time-honored tradition of suing the government to enforce the rights they should have gotten to start with, and it’s a little bit distasteful for a lot of people,” Davison said. “But that’s just the way it’s done.”