Tag: property taxes

Kansas economic outlook continues improvement in annual Rich States, Poor States Survey

The outlook for the Kansas economy continues marching up the rankings of states in the 18th annual Rich States, Poor…

Opponents of Paola School District’s COLA tax on property valuations launch petition drive

A new twist on the contentious issue of property taxes is being played out in Paola. A “protest petition” aimed…

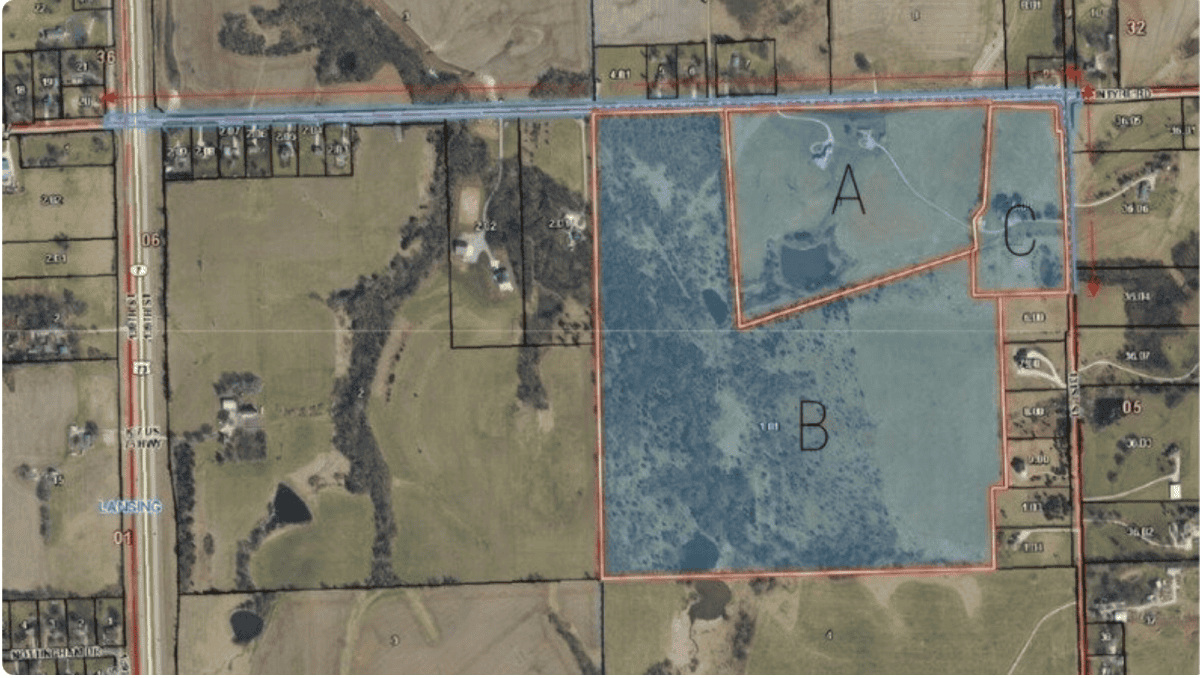

Lansing plan to use property tax incentives for housing development district faces opposition

The City of Lansing is proposing a Reinvestment Housing Incentive District (RHID) using property tax revenue to repay developers over…

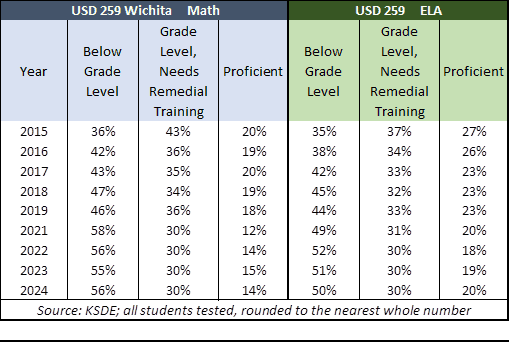

Wichita bond issue appears to have failed, one proponent made deceptive achievement claims

Wichita’s first school bond issue in 16 years appears to have failed by a narrow margin. The unofficial count of in-person…

Kansas Senate passes two minor property tax relief bills

The Kansas Senate passed two bills Wednesday, Jan. 29, 2024, which, if signed into law, will provide much-needed property tax…

House will not take up amendment to limit property valuation increases, Hawkins says

Despite more than 60% of Kansans supporting constitutional limits on property tax valuations, Kansas Speaker of the House Dan Hawkins…

Russell County property owner, county appraiser square off before Board of Tax Appeals

Rising property valuations and resulting tax increases were recently discussed before the Kansas Board of Tax Appeals (BOTA) in Topeka.…

JOCO commissioners increase their salaries 23% after Election Day

After the votes were counted and elections decided, Johnson Countians discovered their property taxes were increasing an average of 5.6%,…

Software error causes Kansas counties to issue incorrect Revenue Neutral notices

As many as 80 of the 105 counties in Kansas sent out miscalculated revenue neutral notices to their taxpayers. The errors…

500% tax increase, lack of transparency frustrates Douglas County taxpayer

Citing property taxes in Douglas County are up more than 500% in the last 25 years, nearly five times as…

Sedgwick County sales tax proposal would simply the tax shift burden and likely increase it

Sedgwick County is floating a new “property-tax relief” proposal that — while it would theoretically lower property taxes — would…

Lansing USD 469 school board to debate budget with a 24% property tax hike

USD 469 taxpayers will gather in Lansing to hear a presentation on the 2024-2025 budget that will exceed revenue-neutral. A…

Leavenworth, Lansing superintendents prepare deceptive property tax presentation

Leavenworth USD 453 Superintendent Dr. Kellen Adams and Lansing USD 469 Superintendent Marty Kobza will discuss property taxes before the…

Easton USD 449 gives taxpayers a win with revenue-neutral budget in upcoming school year

Despite ever-increasing property assessments statewide, school patrons in Leavenworth County’s Easton School District will not pay additional property taxes in…

City of Edgerton falsely claims people are paying less in property tax

The City of Edgerton claims property taxes have declined for the average homeowner since 2008. That’s the message to residents in…

Kansas lawmakers send governor another tax cut bill

After multiple vetoes, the Kansas Legislature believes “Groundhog Day” has ended, and Governor Laura Kelly says she will sign its…

KPI urges Legislature to pass constitutional amendment to limit property valuation increases

The Kansas Legislature, in its upcoming Special Session, should approve a constitutional amendment limiting the annual increases in property valuations,…

Study shows Kansas tax burden is the 12th highest in the nation

While taxpayers await another threatened veto of tax relief, a new analysis shows Kansas has the 12th highest tax burden…

Beloit group claims school board lacks transparency in bond issue campaign

Voters in USD 273 Beloit go to the polls in April to decide the fate of a $20 million package…

Switched vote insures Lansing school district patrons won’t see tax increase

The USD 469 Board of Education in Lansing has approved a budget for the 2023-2024 school year that will not…

Dueling news releases show rift widening in aftermath of Wetmore closing

The ongoing financial dispute stemming from the closure of the Wetmore Academic Center (WAC) between USD 113 Prairie Hills and…

USD 453 budget video makes deceptive property tax claims

New Leavenworth Superintendent Dr. Kellen Adams posted a recent video to justify the proposal for USD 453 to exceed the…

Revenue-Neutral hearing dates set across Kansas…here’s where you can attend

Your chance to tell elected officials what you think of property tax increases is coming up soon, and history indicates…

Kansas has lost 5,500 private-sector jobs in 2023, rest of the region gains

Kansas is the only state in the region that has lost private-sector jobs so far in 2023 according to statistics…