Tag: property tax

Vanity and desire to help local government stand in the way of property tax relief

Republicans and Democrats began the 2025 legislative session with much swagger about passing meaningful property tax reform. However, they adjourned…

County officials object to pro-taxpayer property tax reforms

The leaders of Johnson, Sedgwick, Wyandotte, Douglas, and Shawnee counties collectively came out in opposition to property tax reform yesterday…

Kansas House votes to increase property tax

Yes, the headline is correct. The Kansas House of Representatives today effectively voted to increase your property tax by again…

Voters would decide property tax increases above inflation if SB 280 prevails

Senate Bill 280 would require local governments such as counties, cities and school districts to get voter approval to raise…

House tax committee hears proposal to repeal revenue-neutral; we have a better idea

The Truth in Taxation / Revenue-Neutral Act passed in 2021 is easily the most effective property tax protection that ever…

Cities, counties sitting on more than $5 billion in cash reserves

City and county lobbyists are flooding the state capitol, pressuring legislators not to grant Kansans property tax relief. They tell…

Senate approves 3% limit on real estate valuation increases, but the House may not consider it

The Kansas Senate yesterday passed a constitutional amendment that, if approved by the House, would allow voters to decide whether…

House will not take up amendment to limit property valuation increases, Hawkins says

Despite more than 60% of Kansans supporting constitutional limits on property tax valuations, Kansas Speaker of the House Dan Hawkins…

Senate Tax Committee mulls constitutional amendment to limit real estate valuation increases

For the third year in a row, the Kansas State Senate is considering an amendment to the Kansas constitution that…

Counties approved legislative priorities for 2025

The Kansas Association of Counties (KAC) set its legislative priorities for next year at a recent conference in Wichita. Among…

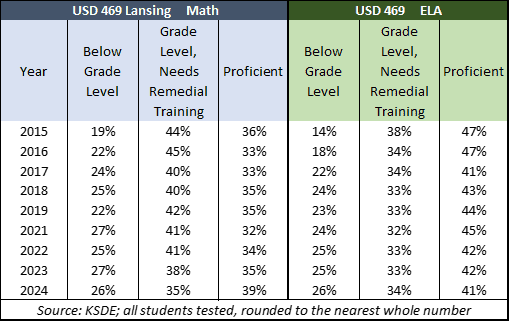

Lansing resident won’t substantiate criticism of school board member Amy Cawvey

Jackie Kennedy of Lansing used part of her allotted time at a recent USD 469 school board meeting’s Public Comment…

Lansing USD 469 school board to debate budget with a 24% property tax hike

USD 469 taxpayers will gather in Lansing to hear a presentation on the 2024-2025 budget that will exceed revenue-neutral. A…

USD 453 should be honest about its proposed 5% property tax increase

At its July board meeting, the USD 453 Leavenworth school board was shown a revenue-neutral rate chart that appears to…

“Scoop and Score” makes false claim, won’t substantiate rosy economic impact of bringing the Chiefs to Kansas

Much like quarterbacks use the “silent count” in noisy situations near vocal opponents, the organizers of “Scoop and Score” working…

Johnson County hires Government Relations Coordinator as taxpayer-funded lobbyist

Johnson County has hired a Government Relations Coordinator at a salary of $122,000 per year. The new position increases county…

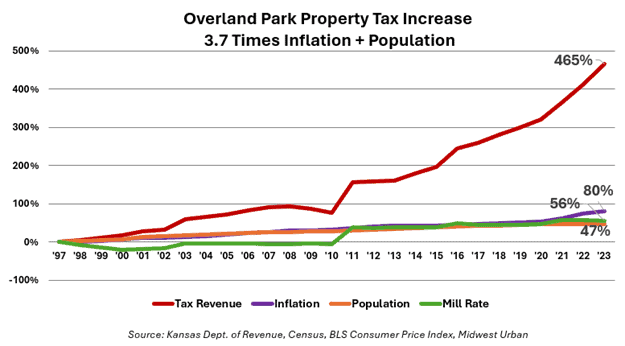

Overland Park Council member Melissa Cheatham deceives residents on property tax hike

Overland Park City Council member Melissa Cheatham recently demonstrated why the Kansas Legislature passed the Truth in Taxation Act in…

Most Kansas cities lost population over the last three years

Most of the largest cities in Kansas have lost population over the last three years. According to data from the…

Former Manhattan mayor defends city’s taxes, salary increases

Manhattan city taxpayers have seen their property taxes increase by 25% since 2019. Since 1997, taxes increased by 351%; that…

Nearly 60% of Kansans favor single tax rate: poll

Americans for Prosperity – Kansas (AFP-KS) has released a poll showing a bipartisan coalition of taxpayers strongly supports replacing the…

Democrats push property tax hike on cars, farms, businesses

With the legislative session just around the corner, Kansas House Democrats are pushing a big property tax increase on cars…

Clerical error saves Merriam residents $1 million in property tax

Merriam residents recently received a postcard informing them of a “clerical error” that will reduce property tax revenue next year.…

House Speaker Hawkins plans to reduce property tax next year

Vowing that “we’re going to give tax relief”, Kansas House Speaker Dan Hawkins floated a property tax cut proposal to…

Former Lansing school board member misleads community on revenue neutral

Former USD 469 Lansing school board member Beth Stevenson is telling the community that holding revenue neutral on local property…

Flat tax in SB 169 is good for Kansas taxpayers

by Grover Norquist and Dave Trabert It was clear from the very beginning. Despite winning reelection on a message of…