As many as 80 of the 105 counties in Kansas sent out miscalculated revenue neutral notices to their taxpayers. The errors are believed to have been caused by a programming error in the software provided by Computer Information Concepts (CIC), since the same error exists in other counties.

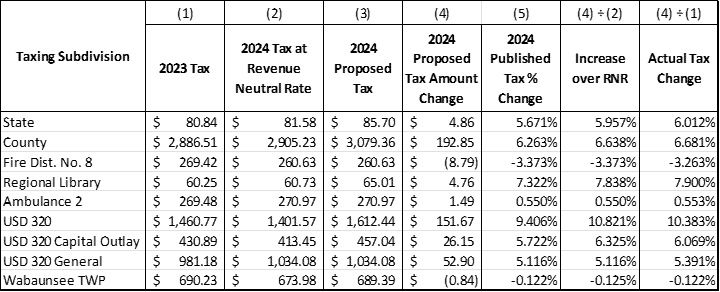

Columns one through five in the table below are recreated from a notice sent to a Wabaunsee County taxpayer. Column (5) shows the proposed percentage increase for each taxing authority, which is calculated as column (4) divided by column (3). The correct calculation of the tax increase over 2023 would be column (4) divided by column (2).

USD 320 in Wamego is among the taxing subdivisions affected by this incorrect notice. Public meetings were held by entities seeking to raise taxes on their patrons as required by the Revenue Neutral law.

We contacted Pottawatomie County Clerk Dawn Henry for comment on the errors:

“There are no issues (with the notices). No one has said there is a problem.”

Henry then refused to provide the software company’s name so we could contact them for comment and a list of the Kansas counties that were supplied with their product. The county clerk advised she would consult with the Pottawatomie County attorney to determine if she was legally allowed to provide the name of the company, despite its software being paid for by taxpayer funds.

We discovered that CIC was the company from another source. We reached out to them for comment. There was no response.

There was no response, either, from the clerks of Wabaunsee and Ellis Counties, other CIC customers whose notices reportedly contained the same miscalculations.

We reached out to the Kansas Association of Counties to see if its members had reported any such errors on revenue neutral notices and to engage KAC in finding a remedy. Kimberly Qualls is the organization’s Communications Director:

“KAC has not been made aware of any Kansas County experiencing the issue that you shared in your email.”

Editor’s note: this story has been updated to reflect the percentage increase over the revenue neutral rate rather than the 2023 actual tax. We regret the error.