A bill recently passed out of the Kansas Senate Tax Committee would be a significant boon to retirees on a fixed income.

Senate Bill 33, the first piece of major legislation to pass out of committee this session, would exempt all Social Security payments from the state income tax.

Current state law exempts federally-taxable Social Security benefits for those making under $75,000 a year. However, even $1 above that and all Social Security benefits are taxed.

There is some consensus that income tax on Social Security needs to be addressed, but the approaches are considerably different.

While the bill authored by the Senate tax committee exempts Social Security entirely, Democrat Governor Laura Kelly’s proposal would raise the threshold for taxation to $100,000.

The bill passed out of committee would save taxpayers about $113 million this year and $363.7 million over the next three years, while Kelly’s proposal would be a more modest $52 million savings over three years.

Kansas is one of only 13 states that tax Social Security benefits in any form while sitting on about $2.3 billion in surplus for the current fiscal year, and it is expected to grow to closer to $3 billion in the following fiscal year. Another 28 states and the District of Columbia do not tax benefits at all, and nine have no income tax at all. Taxing Social Security is one of the reasons that Kiplinger ranks Kansas as the third-worst state for retirees on taxes.

Senate Bill 30 eliminates the inflation tax

A second piece of major legislation — Senate Bill 30 — which also passed out of the Senate Tax Committee, would raise the state’s standard income tax deduction each year based on the cost of living and eliminate the inflation tax.

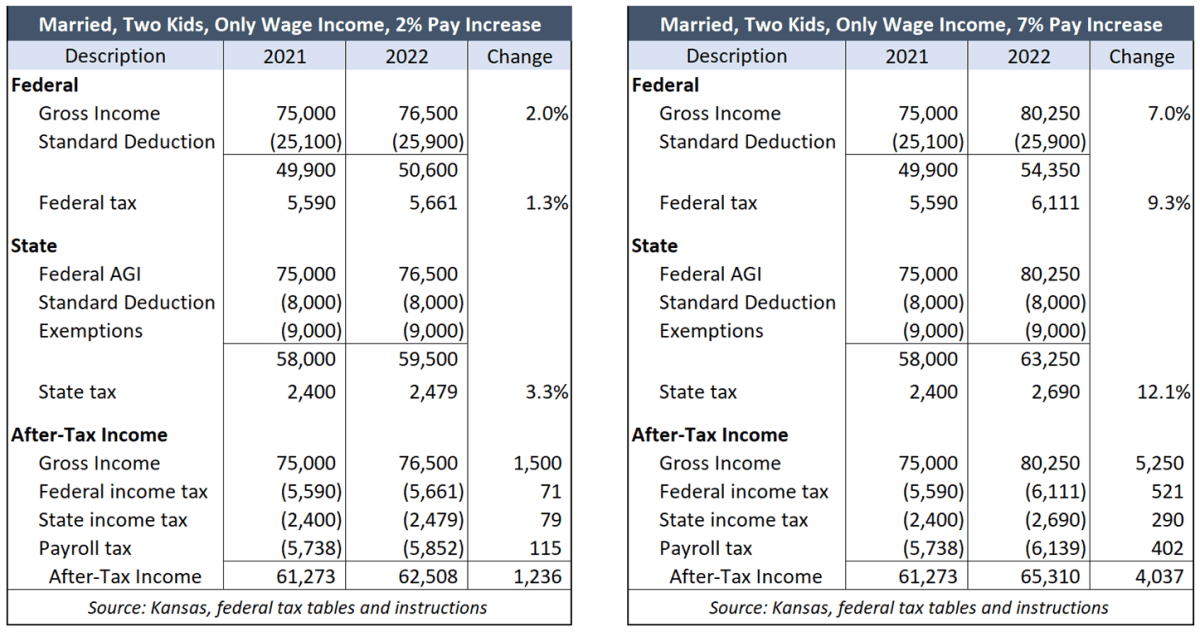

Kansas and other states have experienced large revenue gains recently, and a large portion of that is simply caused by inflation, as demonstrated in the tables below, according to testimony on SB 30 provided by The Sentinel’s parent company, Kansas Policy Institute.

“Let’s say inflation was a little below 2%, as it had been for several years prior to 2021, and a married couple with two children taking the standard deduction had a 2% pay increase in 2022. Their federal income tax would have increased by $71 or just 1.3% because federal standard deductions and tax brackets are indexed for inflation. That couple’s state income tax increased by $79, or 3.3%. They have a larger increase in state tax because the standard deduction and tax brackets are not increased for inflation.

“But if that couple got a 7% increase to offset inflation, their state tax bill would jump by 12.1%. Their federal tax would increase by 9% by comparison because the federal deduction and tax brackets were indexed for 3% inflation in 2022. Their purchasing power didn’t change because of inflation, but the State of Kansas got a 12% boost instead of 3%.”

The standard deductions are currently set at $3,500 for single filers, $8,000 for married couples, and $6,000 for those filing as head of household.

Under the bill being sent to the full Senate, by fiscal year 2026, it is projected that the standard tax deduction would increase to $4,016 for single filers, $9,178 for married couples, and $6,884 for the head of household.

The bill would save taxpayers about $99 million over three years. Collectively, SB 30 and SB 33 save taxpayers $113 million this year and $463 million over the next three years.