Residents gave Johnson County commissioners an earful at the August 12 public hearing on the county’s 2021 budget proposal, which includes another property tax increase.

The reason for the outrage was consistent across all speakers; while individuals and small businesses are struggling to stay afloat, the county is proposing a 5.3% property tax hike and plans to increase spending by 21% over two years (2019 to 2021).

Commission chair Ed Eilert argued they were not raising taxes — using the usual government sleight of hand — because the proposed mill levy remains the same at 26.03 mills year-over-year. But several commissioners pushed back on Eilert, including Mike Brown, who got Eilert to admit that the county could reduce the mill to prevent the tax increase.

Kansas Policy Institute CEO Dave Trabert, who spoke as a Johnson County resident, noted the $14 million property tax increase budgeted for 2021 is on top of the $16 million increase charged this year.

“People pay their property taxes in dollars, not mill rates,” Trabert said.

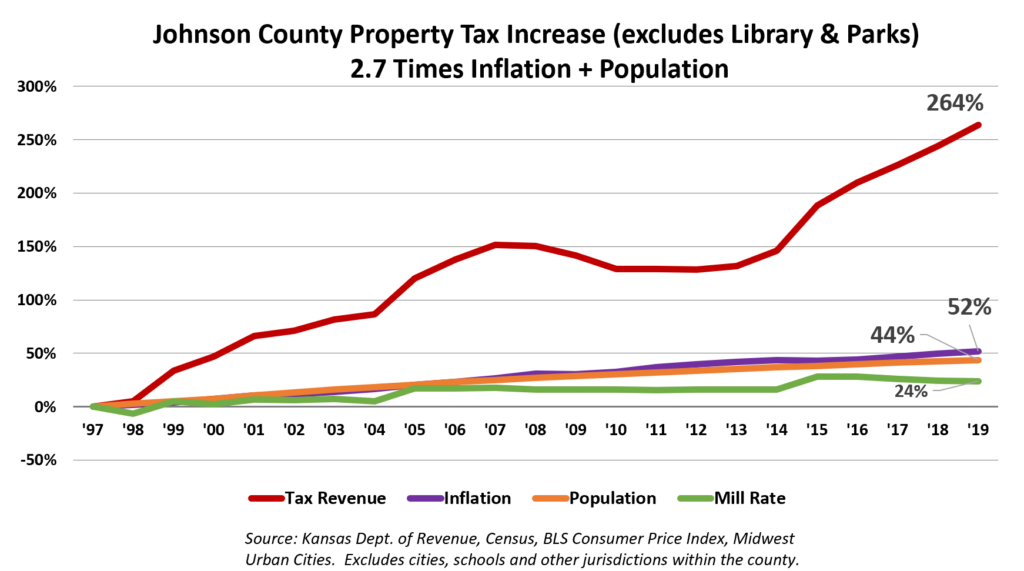

In a chart handed to the commissioners by Trabert, the reality of property taxes in the county was made starkly clear.

Since 1997, property taxes in Johnson County have gone up 264 percent, while inflation was 52 percent and population increased by just 44 percent — making the property tax increase almost three times as much as inflation and population combined.

All of that is leaving aside the county’s illegal attempt to almost double property taxes on large retailers, using the widely-discredited “Dark Store Theory.” The Kansas Board of Tax Appeals says “…the County admittedly is making its record for an appeal seeking the reversal of Kansas precedent…” in its attempt to almost double property taxes on those businesses.

One elderly resident, Bill Carmody, noted he’s still working at age 89, in part to pay a property tax and insurance bill more than twice what the mortgage payments were on his house — before he paid it off 26 years ago.

“The house payment was $168 a month, now … my taxes and insurance are $260 a month. I’m 89 years old, I have to cut things out of my life so that I can pay those things,” Carmody said. “I still work, and if the weather’s bad I go home and don’t get paid.”

He went on to suggest that if there wasn’t enough work for commissioners to do in an 8-hour day, perhaps they should go home and not get paid.

Perhaps most telling were comments from local business owner Rebecca Shipley.

“I own a small business in this town and four of you voted to shut me down and keep Walmart open and collect less tax revenue and then bill me for it,” she said. “I am drowning, working harder than I ever had … you want to hand me a glass of water and bill me for.”

Nearly in tears, Shipley went on to describe how the shutdowns and property tax increases are impacting her business — and others.

“I can’t take it and I promise you other small businesses are feeling the same way, and they’re probably not here because they’re at home trying to figure out who to lay off tomorrow,” Shipley said in a shaky voice. “An increase of any kind is absolutely outrageous and a slap in the face for all of us struggling in this town and county.”

Several commissioners, including Chairman Eilert, sat stone-facing while residents pleaded with them to oppose the tax increase. Commissioners will make their decision on the budget and the proposed property tax increase later this month.