The Senate Assessment and Taxation Committee held a hearing today on a new flat tax bill that is a compromise from previous efforts. The flat tax compromise features in SB 539 include:

- The overall savings is less than the previous flat tax but much greater than Gov. Kelly’s plan.

- Low-income taxpayers get the most significant dollar savings in the first year and the largest percentage reduction each year.

- Middle-income taxpayers get about the same savings over time as the highest incomes.

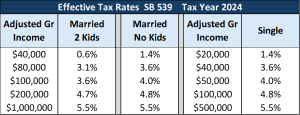

- The single-rate system in SB 539 has progressive, effective tax rates, meaning those who earn the most pay the highest percentage of tax on their income.

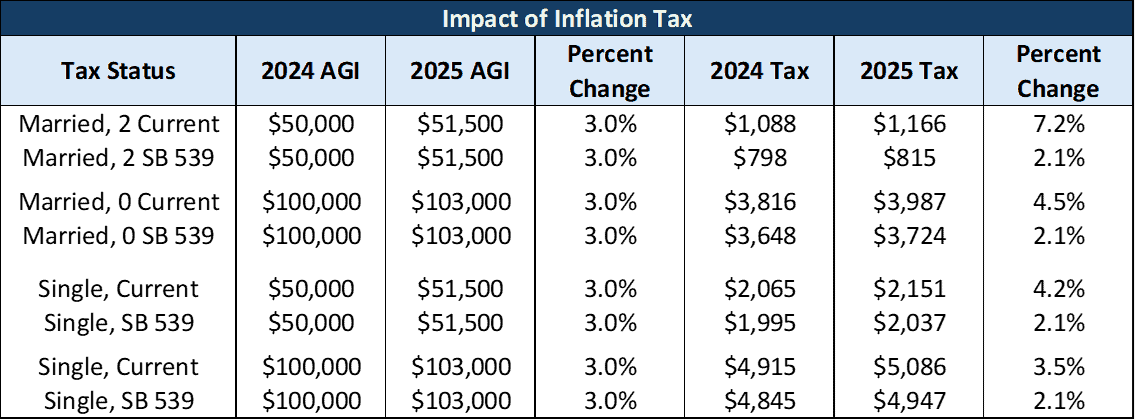

- The single-rate system in SB 539 eliminates the inflation tax in the current 3-rate system.

A family of four with an adjusted gross income of $40,000 would get a tax refund of $468 under Senate Bill 539. That same family would have owed $16 last year under current law, according to calculations from Certified Public Accountant Nick Novelly, who testified in favor of the legislation before the Senate Committee on Assessment and Taxation.

The flat rate in SB 539 begins at the current top rate in Kansas of 5.7% but cushions the effect of that higher rate by exempting the first $22,000 of income, reducing that family’s taxable income. The rate drops by 0.05 percentage points each year for five years, stopping at 5.45%.

Novelly showed some income tax savings at higher incomes of $60,000, $80,000 and $850,000. A family of four with $60,000 AGI would save $243; the savings is $167 for an $80,000 AGI, and the savings is $168 for a family AGI of $850,000.

Supporters tout that SB 539 addresses a major objection to the most recent flat-tax proposal vetoed earlier this session by Governor Laura Kelly; that it benefitted wealthier Kansans. The new bill also eliminates the tax on inflation that is in the current 3-rate system preferred by Governor Kelly.

The standard deduction, personal exemptions, and dependent exemptions are indexed for inflation beginning in tax year 2025. That nearly eliminates having to pay higher taxes because of inflation.

For example, a couple with two children whose AGI increases 3% – from $50,000 to $51,500 – has the entire increase taxed at 5.25% in the current system, resulting in a 7.2% tax increase. If inflation were 3%, the couple’s purchasing power wouldn’t change, but they would still get a tax increase. However, under SB 539, only $420 of the pay increase is taxable because they get higher inflation-adjusted deductions for the standard deduction, personal exemption, and the amount exempt from taxation. In this case, a 3% pay increase only results in a 2.1% tax increase, leaving the couple with a slight increase in buying power.

Put differently, the State of Kansas profits from inflation with a three-tier tax system that isn’t indexed for inflation, but the taxpayer is better off in an inflation-indexed flat rate system.

Effective tax rates are progressive in the flat tax proposal

Taxable income is assessed at a single rate with a flat tax, but the effective tax rates (tax owed as a percentage of adjusted gross income) are still progressive. In other words, the more you make, the higher the effective tax rate you pay.

Taxable income is assessed at a single rate with a flat tax, but the effective tax rates (tax owed as a percentage of adjusted gross income) are still progressive. In other words, the more you make, the higher the effective tax rate you pay.

A family of four with a $40,000 income pays an effective tax rate of 0.6%. The ETR is 3.1% at $80,000 and 3.6% at $100,000. A family income of $1 million pays a 5.5% effective tax rate.

Reducing income tax is important for economic growth, as states with lower tax burdens have superior job growth. The Sunflower State ranked #44 in the country in private-sector job growth between 1998-2022.

After three years of SB 539 being in effect, the state would still have $4.8 billion in reserves.

Several others testified in favor of SB 539, and no one spoke against the bill, although there was some written opposition testimony.