Parental support for school choice is on the rise in Kansas and across the nation, but the Kansas education lobby is fighting an expansion of the tax credit scholarship program that helps poor students attend private schools. Implemented in 2015, the Kansas Tax Credit for Low Income Students Scholarship Program gives taxpayers a state income tax credit for donating to the program. In turn, some students in the bottom-ranking 100 public schools can use the funds to get a better opportunity.

According to Dr. Delia Shropshire, President of Holy Savior Catholic Academy in Wichita, the program offers low-income families the opportunity to enroll their kids in private school.

“We know that it is not about public versus private. It is about our children being successful,” she told the Senate Education Committee in a hearing last week. “We also know that every child develops, learns, and flourishes in different environments. With this opportunity, we can ensure that every child has the chance to learn, grow and develop in an academic environment that meets their needs academically, culturally, socially, emotionally, and spiritually.”

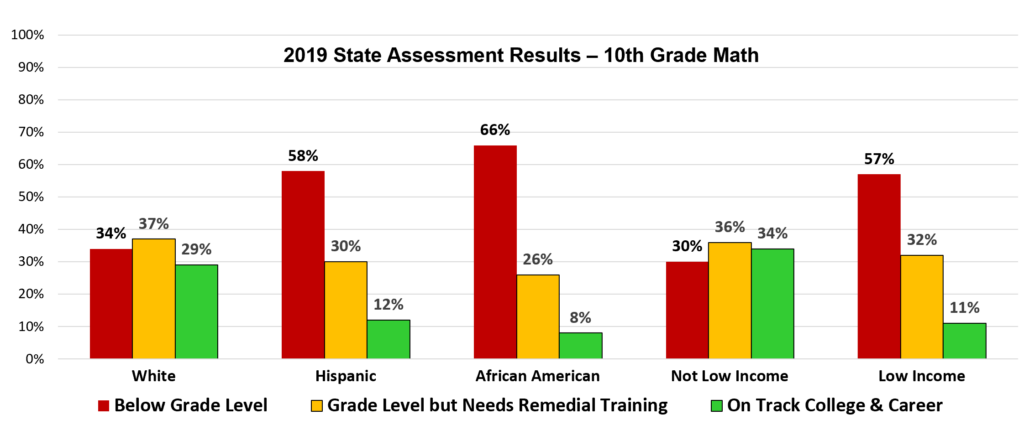

Achievement gaps for students of color and low-income students are large and getting worse. The 2019 state assessment shows 34% of White 10th-graders below grade level in Math, compared to 58% for Hispanic students and 66% of African American students.

Low-income 10th-graders are about twice as likely to be below grade level (57% vs. 30%), while more affluent students are three times as likely to be on track for college and career (34% vs. 11%).

The Kansas education lobby — school boards, teacher unions, PTA, administrator associations, etc. — remains stubbornly focused on institutional interests while attracting national attention for attacking opportunity.

A column at Forbes.com by EdChoice scholar Mike McShane says, “Legislators shouldn’t let the mindless cacophony of naysayers stand between low-income Kansans and educational opportunity.”

Improving education outcomes for Kansas kids

Many Kansas students, especially those from poor families, are struggling, according to Kansas Policy Institute President James Franko. (KPI owns the Sentinel).

The National Assessment of Educational Progress composite scores dropped from 2017 to today, he told the Senate committee.

Only 20% of Kansas 4th-graders are proficient in reading, compared to 48% for their more affluent classmates. The gap is even worse in math, with 25% of low-income students compared to 57% of the more affluent.

2020 ACT scores for Kansas students are also lower than they were 20 years ago, and reveal that only 23% of Kansas graduates are college-ready in English, reading, math, and science; college-readiness dropped from 27% in 2019.

Franko said some students are forced to attend underperforming schools while other students struggle to find a suitable fit for their educational needs.

“That’s not to say that teachers and school administrators are not amongst our most dedicated citizens. It is simply a recognition of fact and experience,” Franko said.

The goal of expanding the program is to give every Kansas kid the chance to succeed, he said.

“That will mean attending a high-performing public school for most children, but it should also include a different avenue for children where the local public school does not seem to be the right fit,” Franko said.

Kansas program tiny compared to other states

Libby Knox, director of development and tax credit scholarships for Catholic Education Foundation, told the Senate committee that the Kansas program is tiny.

“To put this in perspective, there are 632 students currently participating in this scholarship program in Kansas,” she said. “There are more than 500,000 students in K-12 education in Kansas. This is a very tiny part of the education efforts to improve student outcomes in Kansas.”

Kansas is one of 29 states with vouchers, ESA, and/or tax credit scholarship programs. Kansas’s tax credit scholarship initiative spends about $2 million of privately raised funds or about 0.04% of the state’s combined program and K-12 education funding, and about 0.03% of the state’s combined education expenditures. EdChoice ranks Kansas’s program 26th in terms of the share of education spending.

There are 24 tax credit scholarship programs in 19 states. Of those, 16 include income limits, including the Kansas program. The Kansas plan only offers scholarships to students in the 100 worst-performing schools. In most states, public school performance is not a criterion for using a tax-credit scholarship. According to Michael McShane, the director of national research at EdChoice, Kansas’s program is one of the most stringent in the country.

“As it’s currently administered, the Kansas tax credit program is an outlier,” McShane said.

Proposal would expand program eligibility

Kansas legislators forwarded two pieces of legislation out of committee that will expand the existing tax credit scholarship initiative. Senate Bill 61 and House Bill 2068 would make students who receive reduced lunches eligible for the program. Currently, only those who receive free lunches qualify. Last school year, there were 178,504 students across the state who qualified for free lunches, and 48,903 students qualified for reduced-price meals.

Shropshire said that that small change would have a big impact.

“Imagine how many more students we can help if the law is expanded to families who qualify for reduced lunches,” she said. “There are many reduced lunch eligible families each year who inquired to enroll but could not afford tuition. These families would be the beneficiaries of the bill.”

Today, only students who attend the lowest-ranked 100 schools in Kansas have an opportunity to use the program. However, SB 61 and HB 2068 eliminate that requirement, opening the scholarship program to low-income students in any public school.

Knox testified in both a House and Senate committee in support of expanding the scholarship opportunity program. She said some low-income children are denied access to the scholarship program based on their street address.

Under the existing program, “children on one side of the street, who live within the boundaries of the ‘100 schools list’ can qualify, but students on the other side of the street, or in the next town, cannot,” she said.

Public support for vouchers at an all-time high

The popularity of school choice programs is rising, in part, thanks to pandemic-related school closures. An EdChoice poll found that support for school vouchers and educational savings accounts is at an all-time high. The group’s most recent poll showed that 81% of respondents support the creation of education savings accounts, and 78% of respondents support voucher programs. Nearly two-thirds, 74%, support tax-credit scholarship programs, and 72% support charter schools.

Despite the public’s appetite for tax-credit scholarships, the effort to expand Kansas’s program faces significant opposition from school board advocacy groups, public school parent-teacher associations, and teacher’s unions.

Mark Desetti, a lobbyist for the Kansas National Educators Association, said the proposal doesn’t focus on struggling or at-risk students, allows private schools to cherry-pick students, and doesn’t include accountability for student performance.

“There is no requirement that the private school be a state-accredited school,” he said. “Without a requirement that the private school participate in the accreditation system, there is no ability to even compare the private school performance overall to the public school. We may be sending students to failing private schools with state money.”

Desetti doesn’t mention improved performance isn’t required for public schools to be accredited. In fact, the Kansas Department of Education told KPI that they cannot recall when a public school lost accreditation. Desetti also neglected to mention that low-income kids in private schools have much better performance on the state assessment test than those in public schools.

Program funded by donors, not direct tax payments

Shawnee Mission School District Superintendent Mike Fulton joined a handful of other superintendents from across the state in opposing the proposals. Fulton said the eligibility expansion alters the original intent of the scholarship program, which was to provide options for certain low-income students.

“Such changes will funnel public dollars primarily to families who already are availing themselves of private school options, decreasing the resources available to the vast majority of public school students,” he said.

Franko says Fulton’s statement isn’t true.

“He is either consciously making a false statement or is woefully misinformed.”

Existing eligibility guidelines require new applicants to be enrolled in a public school, and the expansion proposal does not change that. Students already enrolled in private schools would not become newly eligible under the proposed changes.

The scholarship program doesn’t use state funding directly. Instead, it allows businesses to donate to the program in exchange for a 70% tax credit. However, the bill does carry a fiscal note of $10 million. The current program costs $2 million, though the funding comes from private donors.

Public school advocates say private schools discriminate

Several individuals offered testimony concerned that private schools will turn away undesirable students.

“There is nothing in this bill that requires participating schools to provide transportation or lunches and they are not required to take all of those that apply,” Gould said. “…They are also free to counsel out students who turn out to be more difficult, sending them back to public schools.”

Michael Poppa, the executive director for Mainstream Coalition, said the legislation perpetuates discrimination. He said the proposal doesn’t prevent a private school from rejecting students based on religion, disability, sexual orientation or gender identification. It blurs the line of separation of church and state, he said.

“The Mainstream Coalition espouses the separation of church and state as one of our founding principles, and regrets that the proponents of this bill feel Kansas taxpayers should pay for private, religious schools with no regard for student outcomes,” Poppa said.

Courts across the nation refute Poppa’s contention, saying that allowing parents to decide how to spend education dollars does not violate constitutional separations of ‘church and state.’ Indeed, if the Kansas education lobby believed there was a constitutional violation, they likely would have sued when the program was implemented in 2015 — but didn’t.

Education lobby attacks opportunity – Part 2

Part 2 of this series on the education lobby attacking opportunity for low-income students will explore the Shawnee Mission school district. Since the district opposes tax credit scholarships for low-income kids, the Sentinel asked about their plan to get those students to grade level, and how long they think that will take.