Media rightfully gets a lot of criticism for bias, but Kansas Public Radio (KPR) deserves credit today for having the integrity to correct an inadvertent false statement it made earlier this week.

The March 28 Headlines at Kansas Public Radio (KPR) quoted an inaccurate report from the Kansas News Service, saying the Kansas education budget “would increase special-ed funding by requiring districts to shift about $130 million of local property tax money toward special education.” (emphasis added) KPR edited the story after The Sentinel provided proof from the Kansas Legislative Research Department that the budget shows an increase of $82 million, going from $528 million this year to $610 million next year. That is real money and not a shift from other sources.

The original story left a false claim by Rep. Dave Younger (R-Ulysses) go unchallenged. Today, KPR writes that Younger’s claim is contrary to KLRD data.

“Republican Rep. Dave Younger, a former superintendent from Ulysses, thinks the measure would shortchange schools and does not amount to more funding. “Using local property tax to pay for special-ed funding is not a viable option. Any other calculation is voodoo math,” he said.

“Younger’s statement is at odds with figures from the Kansas Legislative Research Department. Under the bill passed by the House, special education funding in Kansas would increase from the current $528 million to $610 million in the next fiscal year.”

Kudos to KPR for calling out Rep. Younger, who must know he is not being honest. The budget was explained to all legislators, and the Supplemental Note to the budget bill specifically addresses funding increases for special education.

Special education funding increase and LOB transfer are two separate issues

There are two things at play here: (1)the Legislature is adding money to Special Education and (2) separately requiring Local Option Budget money related to special education to be counted toward the formula that says the state must reimburse districts for 92% of excess costs.

As we’ve written many times (and has been repeatedly explained in the Legislature), the formula gives the state credit for some weightings (money provided above the base) but not all weightings. It also gives credit for some of the Local Option Budget funding related to special education, but not all of it. KSDE officials tell legislators they don’t know why all the funding isn’t counted. Absent any valid legislative intent to only count partial funding toward the 92% goal, the formula is likely inadvertently flawed and is appropriately corrected in the new budget bill.

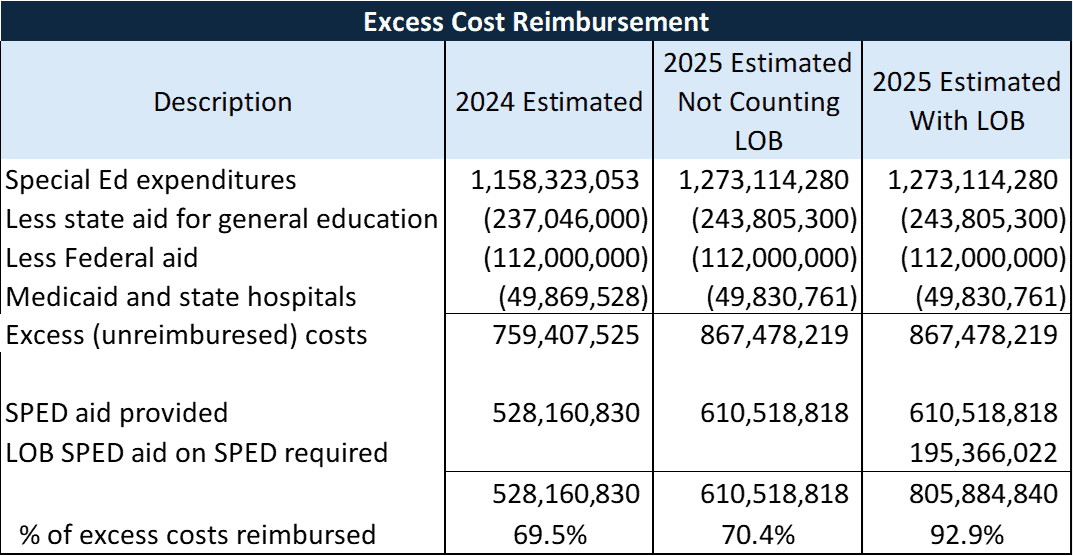

The table below shows state funding of $528 million reimburses districts for 69.5% of excess costs this year. With funding of $610.5 million next year, the state would fund 70.4% of excess costs under the current formula, or 92.9% of excess costs, counting the LOB money districts collect because of special education funding.

Regardless of whether one believes LOB should count, school districts will get $82 million more funding next year if the formula correction remains in the bill signed by Governor Kelly.

(editor’s note: the original story understated special education expenditures in the version of 2025 that doesn’t count LOB)