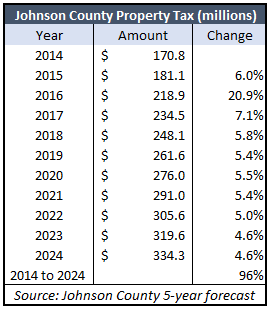

Johnson County released 5-year budget projections for the county, and the county is projecting annual property tax increases that are more than double the rate of inflation. The forecast assumes no change in the mill rate; all property tax increase comes from changes in property valuations and the increases apply only for county operations. Cities, schools and other taxing jurisdictions aren’t included in the projection.

While inflation has been less than 2% every year since 2014, Johnson County officials imposed a 6% increase in 2015, followed by a 20.9% hike in 2016 and 7.1% more in 2017. Property taxes increased 5.8% last year Johson County is showing a 5.4% jump this year. Projections for 2020 through 2024 range from 4.6% to 5.5%.

While inflation has been less than 2% every year since 2014, Johnson County officials imposed a 6% increase in 2015, followed by a 20.9% hike in 2016 and 7.1% more in 2017. Property taxes increased 5.8% last year Johson County is showing a 5.4% jump this year. Projections for 2020 through 2024 range from 4.6% to 5.5%.

The county noted that “revenues are estimated using a conservative approach to avoid budget shortfalls.”

Valuations are not the only area that growth is projected to outpace inflation. Johnson County is projected to increase salaries 3-4%. The 2020 growth rate is set at 3%, which is already above inflation. However, the projected year-over-year growth rates for the county will be nearly double that of inflation for the next five years.

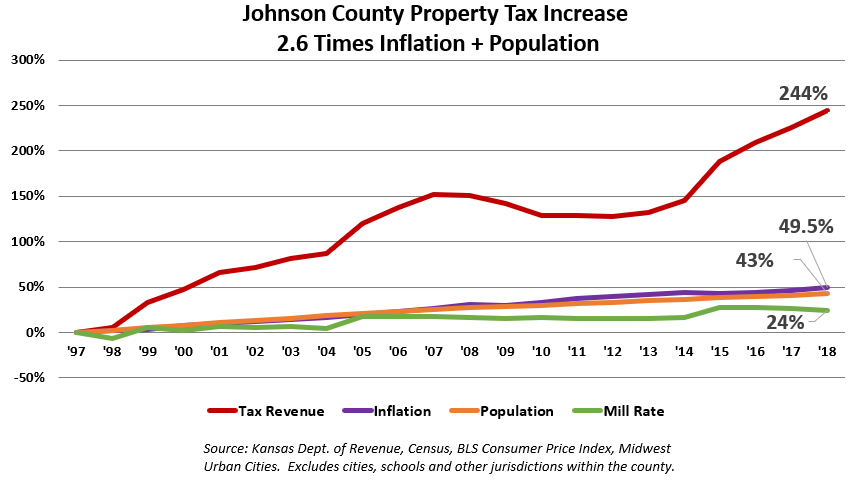

Since 1997, Johnson County increased property taxes by 244%, which is 2.6 times the combined rates of inflation (49.5%) and population growth (43%).