Governor Kelly’s budget director, Adam Proffitt, tells legislators that the flat tax in HB 2284 puts the state into budget deficits starting in FY 2029, but he doesn’t show the basis for that claim. However, using data from Kansas Legislative Research and ending balances provided by Proffitt’s Division of the Budget shows the Kelly administration is covering up the real cause. The deficit he shows doesn’t disclose more than $1.6 billion in additional spending that Kelly slipped into the forecast.

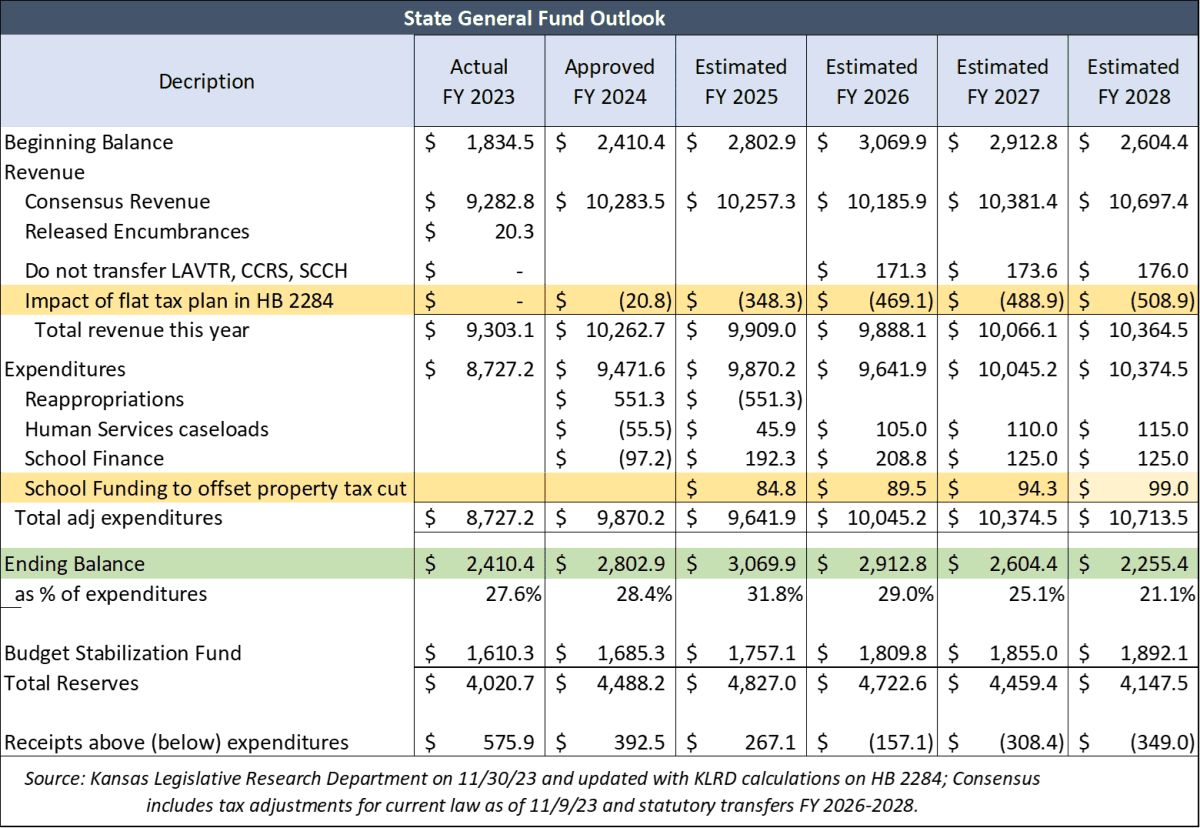

The table below shows the projected ending balances with the flat tax in HB 2284 using Kansas Legislative Research Department data. The KLRD forecast is based on last year’s tax bill, so we substituted the revenue and expenditure impacts of HB 2284 (highlighted in yellow). The extra school funding is for the property tax change in HB 2284. KLRD also added over $1 billion in new spending on human service caseloads and additional school funding.

The state would have more than $4 billion in reserve at the end of FY 2028 between the ending balance of the State General Fund and the Budget Stabilization Fund.

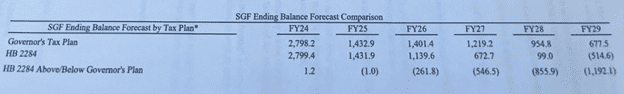

At this writing, Profitt has not provided a copy of their forecast as we requested, but we found a screenshot of their ending balance forecasts on social media that shows the alleged budget deficits in the State General Fund. The report conveniently neglects to mention the $1.9 billion surplus in the rainy day fund.

The comparative impact of the competing tax plans is really a simple math exercise. Suppose the ending balance projection with the flat tax is $1 billion, and the revenue impact of the flat tax is $200 million than Kelly’s plan. If nothing else changes, the ending balance under Kelly’s plan should be $1.2 billion (flat tax balance plus the difference between the two plans).

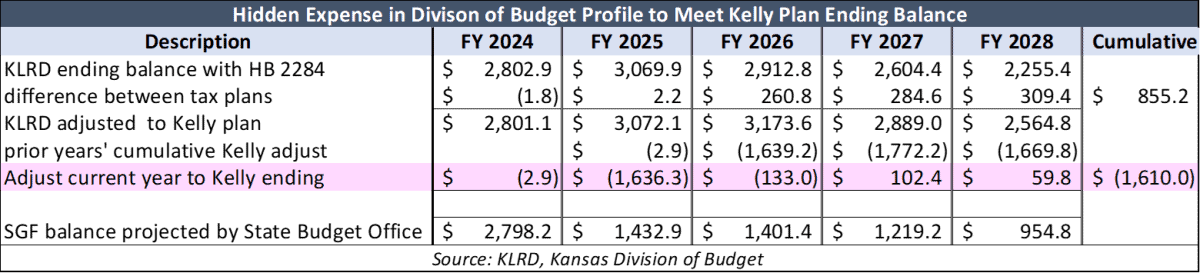

The table below shows a flat tax beginning of $3.0699 billion in FY 2025. The Division of Budget says the flat tax costs $2.2 million more, so the ending balance with Kelly’s plan should be $3.0721 billion. Instead, Budget says the ending balance is $1.4329 billion, which means there is about $1.6 billion more spending in their calculation than the forecast prepared with Kansas Legislative Research data.

The undisclosed spending each year is highlighted in pink.

This analysis can’t be done for FY 2029 because KLRD only projected revenue and expenditures through FY 2028 in the forecast provided.

House Speaker Dan Hawkins says Kelly’s additional spending isn’t going to happen.

“It’s not the single-rate that’s the problem here; it’s Governor Kelly’s spending. They’re basing their claim that our tax plan isn’t sustainable on their massive overspending in her budget proposal. Her pricey plans to expand government add up to a 13.5% increase over last year. Thankfully, the legislature has the responsibility of appropriating the budget, and we will not be spending like a drunken sailor as the Governor recommended.”

Kelly administration should be honest with taxpayers

It’s not the flat tax that is the basis for the alleged budget deficits; it is the $1.6 billion of additional spending that Governor Kelly is trying to slip into the forecast.

The flat tax plan with a rate of 5.25% does not cause budget deficits and provides much more tax relief for low-income families than the governor’s plan.

Kelly seems willing to deprive low-income families of additional tax relief so she can charge the 5.7% tax in her plan on individuals earning more than $30,000 and families earning over $60,000. And she’s not above using fabrication and deception to sustain her political philosophy.

Governor Kelly owes Kansans an apology for these actions. After all of her claims about Gov. Brownback’s alleged duplicity or fiscal ruin—as a senator, on the campaign trail, and in the Governor’s Office—Kansans should be able to expect honesty from her administration.