With the legislative session just around the corner, Kansas House Democrats are pushing a big property tax increase on cars as well as on farms and other businesses.

Kansas House Democrats have proposed an amendment to the Kansas constitution that would shift approximately $308 million from residential real estate to other types of property, resulting in an average 11% increase on motor vehicles, farms, and all other businesses.

House Minority Leader Vic Miller (D-Topeka), speaking on behalf of his caucus, is proposing a constitutional amendment to reduce the assessment ratio on residential property from 11.5% to 9%. Miller acknowledges the $308 million tax increase on farms and other businesses, telling the Topeka Capital-Journal it should be even higher — while suggesting it’s about “fairness.”

“While it might seem unfair to some, it’s actually not fair enough,” Miller said.

The $308 million tax shift could be even higher. The calculations are based on each taxing authority increasing its mill rate to offset the decline in residential property tax.

Dave Trabert, CEO of the Sentinel’s parent company, Kansas Policy Institute, notes in a piece for KPI that Miller’s suggestion is disingenuous.

“He justifies the shift by claiming residential property owners are paying a greater share of the tax burden than they once did; however, that is a consciously deceptive claim,” Trabert wrote. “Residential tax collections have increased because home values have grown faster than the value of other classes of property. Miller makes it sound as though farms and other businesses aren’t paying their fair share, even though he knows that all other classes of property are already subsidizing homeowners.”

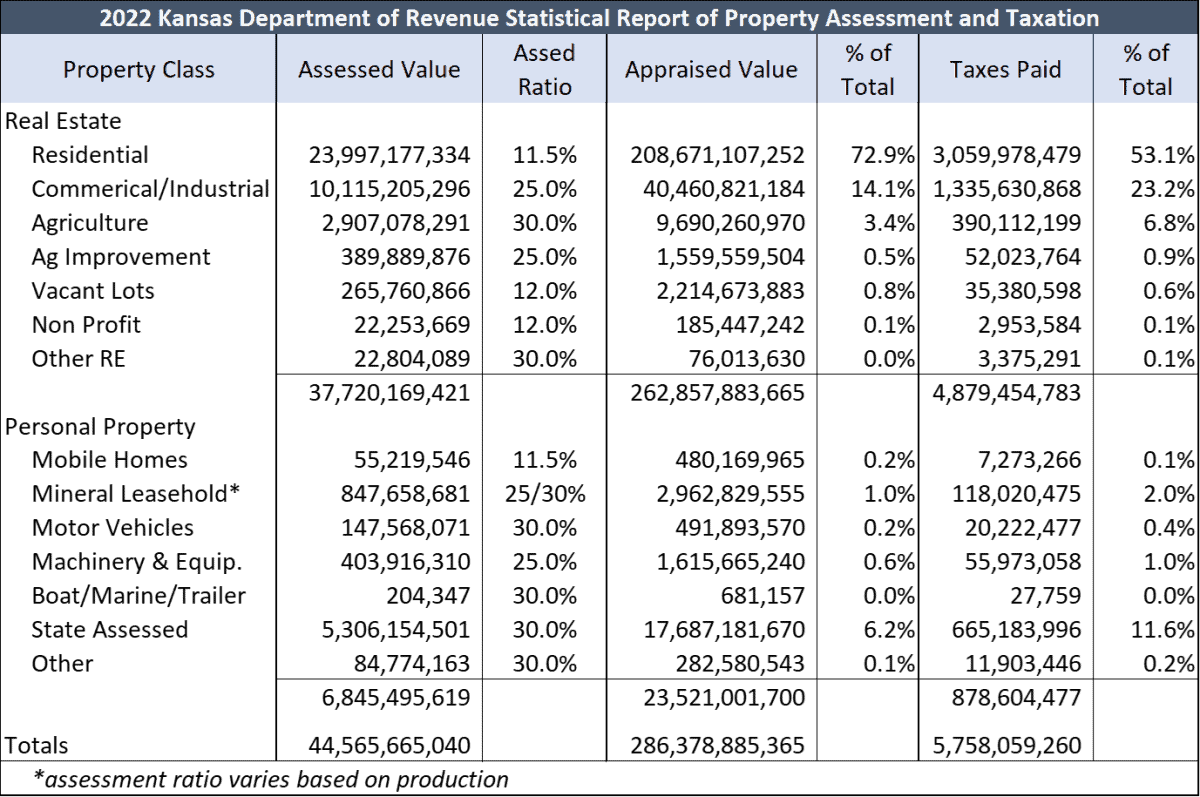

Homeowners collectively pay 53% of all property tax, but they have 73% of the total appraised value in the state. In other words, all other property owners are already subsidizing residential property. House Democrats want to make it worse.

Commercial & Industrial property (including machinery and equipment) accounts for 15% of appraised value but pays 24% of the taxes. Agriculture Land and Improvements represent 4% of the appraised value but pay 8% of the tax. House Democrats’ proposal would exacerbate the already disproportionate share of taxes paid by non-residential property owners.

Two factors already reduce the share of property tax paid by homeowners. Residential property is assessed at 11.5% of appraised value, whereas business property is assessed at 25% or 30%, which results in non-residential property owners paying two to three times the effective property tax rate (tax divided by appraised value).

Also, the first $40,000 of assessed home value is exempt from the 20 mills of state property tax levied by school districts but not other classes of property.

And, as Trabert notes, the reality of Miller’s plan is much worse in some counties.

Owners of non-residential properties in counties where they comprise a smaller share of total property values will have more severe tax increases because there is a smaller base across which to spread the residential tax cut.

Owners of non-residential properties in counties where they comprise a smaller share of total property values will have more severe tax increases because there is a smaller base across which to spread the residential tax cut.

Assuming that each taxing authority recoups lost property tax on residential reductions by increasing its mill rate just to break even, Leavenworth County would be the hardest hit, with a 20% increase on non-residential properties.

Ironically, Miller’s plan has more severe impacts on non-residential properties in counties with a higher base of Democrat voters, including Douglas (18%), Johnson (18%), Riley (17%), Sedgwick (16%), Shawnee (15%), Saline (14%), and Wyandotte (13%).

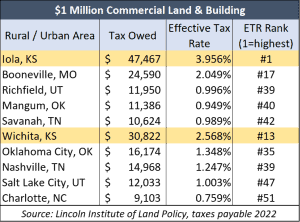

Kansas businesses already pay some of the highest effective property tax rates in the nation (because business property subsidizes residential property), and House Democrats’ plan would exacerbate an already uncompetitive situation. The most recent analysis by the Lincoln Institute of Land Policy of states and the District of Columbia shows Iola, Kansas, has the highest effective property tax rate among rural areas in the nation. A property valued at $1 million in Iola pays over $47,000 in property tax; the same property in Booneville, Missouri, pays a little over $24,000, and just $11,000 in Mangum, Oklahoma.

Kansas businesses already pay some of the highest effective property tax rates in the nation (because business property subsidizes residential property), and House Democrats’ plan would exacerbate an already uncompetitive situation. The most recent analysis by the Lincoln Institute of Land Policy of states and the District of Columbia shows Iola, Kansas, has the highest effective property tax rate among rural areas in the nation. A property valued at $1 million in Iola pays over $47,000 in property tax; the same property in Booneville, Missouri, pays a little over $24,000, and just $11,000 in Mangum, Oklahoma.

Wichita is rated the 13th highest in the nation, paying almost $31,000 in tax, whereas the same property in Oklahoma City pays just $16,000.

Democrats’ property tax plan benefits government at taxpayers’ expense

Trabert also notes that government is the beneficiary of Democrats’ property tax proposals. Raising taxes on non-residential property owners is damaging to the state, but proponents take credit for reducing taxes on homeowners.

Another proposal backed by House Democrats would give $130 million of state taxpayer money to cities and counties so they can theoretically use it to reduce property tax. The proposal would resurrect the Local Ad Valorem Tax Reduction (LAVTR) plan that failed miserably and hasn’t been funded since 2003. Local officials used the state money to spend more and imposed property tax increases averaging more than 7% annually in the program’s last five years.

Instead, Kansas Speaker of the House Dan Hawkins (R-Wichita) proposes a flat income tax of 5.15% with provisions ensuring everyone saves money. The plan in Senate Bill 169 (which Gov. Kelly vetoed this year and the Legislature failed to override) would save Kansans about $370 million each year. Kelly wants to give a one-time rebate of $450 instead.

“A rebate would allow her to continue growing state spending unnecessarily and have far less economic impact on the state’s economy,” Trabert wrote. “Kelly and other Democrats are focused on giving the appearance of tax relief while keeping the interests of government front and center.”