Johnson County recently announced a 12% increase in residential property values for 2023, which officials say is justified because the median sales price spiked. But as the Sentinel found in Miami County, the change in median sales price doesn’t seem to justify the big jump in appraisd values.

The median sales price is determined by listing all prices in ascending or descending order and finding the midpoint – where half the homes sold for more, and half the homes sold for less. A change in the distribution of sales from one year to the next therefore can materially change the median regardless of market conditions. It’s just basic math.

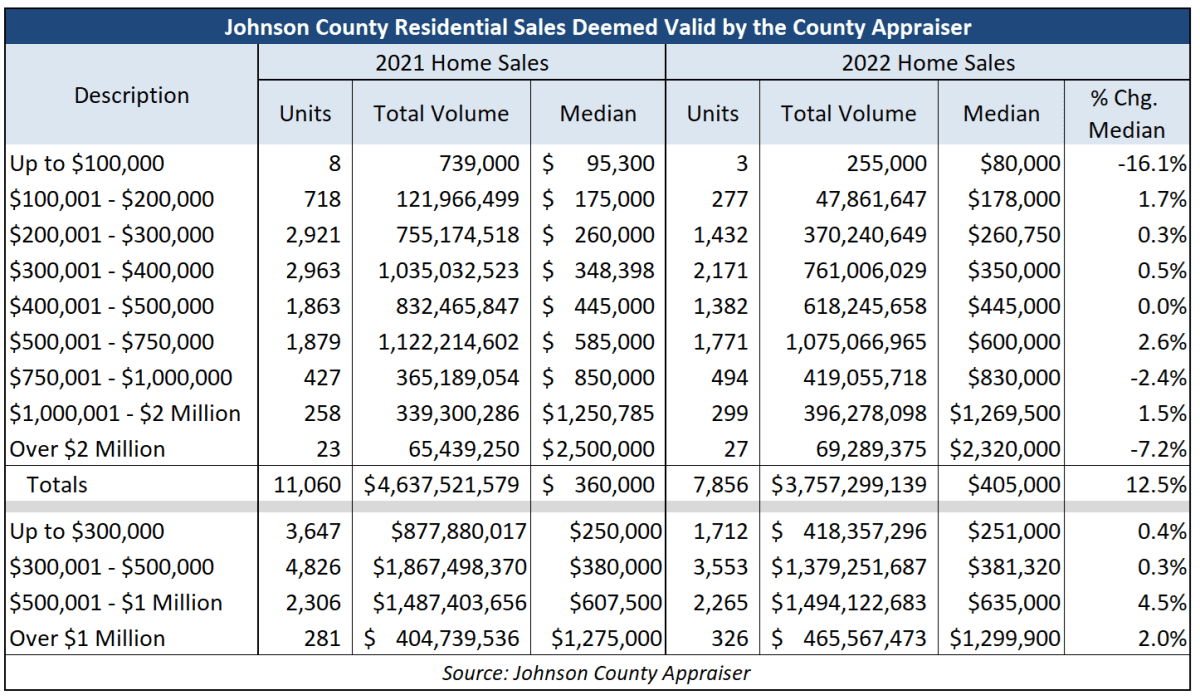

The Sentinel obtained the list of residential sales (including single-family, multi-family, and condos) for the 2021 and 2022 tax years from Johnson County in an Open Records request. There is a 12.5% increase in the median sales price for transactions deemed to be valid sales by Appraiser Beau Boisvert, but that change primarily results from there being fewer sales and a different ‘mix’ of sales values.

The number of sales declined in each tier of sales in $100,000 increments up to a half million dollars, and also for sales between $500,000 and $750,000. The median declined 16% for transactions below $100,000 and the other tiers have increases ranging from 0% to 2.6%. Activity in each tier above $750,000 increased over the prior year, but the median sales price declined in two of the three tiers and there was just a 1.5% increase in transactions between $1 million and $2 million.

Even using broader categories – up to $300,000, between $300,000 and $500,000, between $500,000 and $1 million, and over $1 million – reflects increases in median sales prices in the very low single digits.

If history is any guide, county commissioners and city council members in Johnson County will use inflated valuations to impose big tax increases on homeowners, so taxpayers should get their appeals on file before the March 29 deadline.