While the “pronoun pins” the Johnson County government recently purchased are a fairly minor cost to the taxpayers, the big raises Johnson County wants to pay will be in the millions.

A salary study contracted with Salary.com (formerly CompData), which conducted prior surveys, suggested a more than 6% average salary increase across the board — which would mean a cost for Johnson County taxpayers to the tune of some $18.3 million.

According to the presentation, the total number with various “offsets” the budget impact would be around $12.6 million — still a significant cost to taxpayers.

Slides from a recent Johnson County Commission “Committee of the Whole” meeting show the county claims it has a “hiring crisis” and that the reasons are “finding qualified candidates” and “competitive compensation.”

According to the slides, the county’s turnover rate has increased from 12.6% to 16.9% since 2018, and vacancy rates for jobs within the county have increased from 8.8% to 12.2% over the same time-frame.

According to the presentation by County Manager Penny Postoak Ferguson at Thursday’s “committee of the whole” meeting, the problem is historically low unemployment rates, high job growth and a labor shortage which “has led to a fiercely competitive labor market exacerbated further by a pandemic. This coupled with our high vacancy and turnover rates has presented a critical talent management issue for Johnson County Government.”

Ferguson said the county’s “market pay position is less than competitive,” and has “worsened recruitment and retention efforts.”

The survey doesn’t appear to have examined whether Johnson County is overstaffed, however. Payroll records obtained by The Sentinel’s parent company, Kansas Policy Institute, reflect a very top-heavy organizational chart. County manager Penny Postoak Ferguson was paid $290,000 in 2021, and both the assistant and deputy county managers were paid over $200,000. Johnson County Parks and Rec also has a lot of highly paid managers.

Commissioner Becky Fast repeatedly asked Ferguson if the proposed increases would be a “blanket increase,” and Ferguson demurred, saying it was a “market increase.”

“So the recommendation is not a blanket increase, but as a market based …” Ferguson said before being interrupted.

“But it’s still a blanket increase; it’s the same; it’s not based on performance,” Fast said.

Ferguson again defended the study.

“So this is a market study to look at by grade level and looking at the particular job classifications, what the market’s like, so it is focused on the market,” she said. “Then merit would be addressed separately, through the budget process.”

In other words, employees could see a significant “market based bump,” should the recommendations pass, and then another “merit” raise as well, meaning the cost to taxpayers could be significantly more than the $18.3 million suggested.

Commissioner Jeff Meyers said the commission “couldn’t argue,” what had been presented to them.

“What I’m seeing is that on benefits, we’re still in a pretty good place,” Meyers said. “But what I’m also seeing is that on pay, we have a discrepancy, and it needs to be addressed. “I think that’s not only an expectation, but it’s warranted.”

Commissioner Michael Ashcraft, however, disagreed.

“I think we should argue about this,” Ashcraft said. “I think there should be a full vetting because the price tag, as Commissioner (Patrick) Harris pointed out, is going to be significant.”

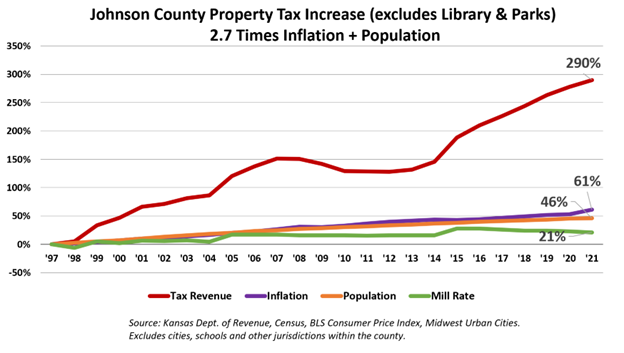

Commissioner Charlotte O’Hara pointed out to Ferguson that projections tend to be risky, and it was possible that — as an example — the mental health department’s budget, which is largely funded through the state, could, with a change of administration, see state funds cut, and end up largely on the property tax mill levy. County commissioners have increased property tax by 290% since 1997, which is nearly three times the combined rates of inflation and population change.

“So we make decisions on the information that we have at hand, knowing that in the future things do change, just like we’ve done over the 20 years I’ve been here,” Ferguson said. “If things do change, if the revenue picture changes, that’s when we come back, and we make adjustments and departments are they understand that as well, and they work through that with us and so again, you know, we feel over a multi year approach that we can factor this in and that’s why I will come to you at the end of March with those projections. But again, I don’t have a crystal ball.”

O’Hara noted that, while she understood how it works, it remained possible that those departments “could be on the mill levy.”

Ferguson dismissed those concerns.

“I would add, also, that there’s other revenue in the general fund besides the mill levy,” She said. “There’s also sales tax and other revenue sources as well.”

However those sources are largely drawn from taxpayers as well, making it something of a distinction without a difference.