A report on performance-based budgeting in Kansas reminds readers of a famous quote about government spending: “A billion here, a billion there; pretty soon, you’re talking about real money.”

This quote has been attributed to legendary Sen. Everett Dirksen, as a critique of a mid-1960’s federal budget. Whether the Illinois Republican actually said it is a matter of conjecture.

Fast forward to 2023, and the quip can apply to this year’s State of Kansas budget, currently pegged at $22 billion. But a law intended to make sure taxpayers get “more bang for their bucks” is ineffective because it’s mostly ignored in the legislative budget process, according to a study by Ganon Evans of the Kansas Policy Institute, owners of The Sentinel, and Michael Austin of the Kansas chapter of Americans for Prosperity.

In 2016, the Legislature passed, and Governor Sam Brownback signed into law Performance-based Budgeting (PBB), intended to measure the goals and results of government programs to determine their effectiveness.

What is Performance-based budgeting?

Performance (or Priority) based budgeting (PBB) is a budget process that asks, “Is the public getting what it paid for efficiently and effectively?” The practice follows the following steps.

- Assign a measurable public benefit to each tax dollar spent. (Outcome)

- Insist state agencies assign measures to ensure they meet such goals. (Output)

- Review performance to assess whether changes in public benefit are meeting expectations.

- Use performance reviews to determine the following year’s appropriation.

The law was supposed to be fully implemented by 2019, but the authors’ review of a Kansas Legislative Research report on PBB and state budgets contends there has been a bipartisan failure to do so:

“Governors Brownback and Kelly did not compel agencies to implement it with fidelity to the spirit of the law.

“Agencies submit their self-determined performance measures, but the vast majority merely reflect activity, processes, or even simply the hiring of more employees. Instead, the system should be built around desired outcomes established by the Legislature in consultation with agencies.

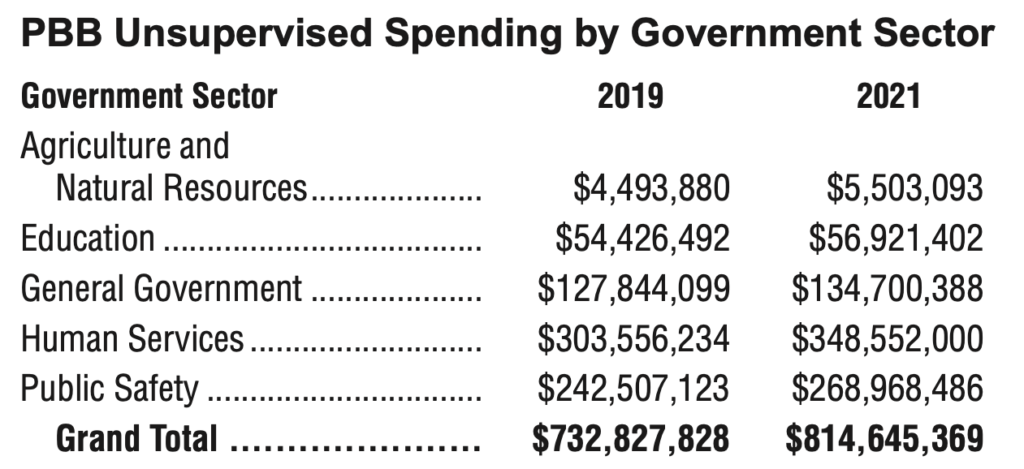

“Using the state’s metrics, we found 132 state programs spending $815 million on programs with declining outcomes in FY 2021. Moreover, included in those state programs were 65 programs that did not report any performance measures despite receiving state taxpayer funds. These are all issues of little accountability and oversight over state programs.”

The authors conclude by urging policymakers to follow the intent of the PBB law:

“Kansas government spending has far outpaced population growth and inflation. As a result, Kansas’ general fund spending is $1.7 billion higher than where it should be

if spending were constrained in line with inflation and population growth. This bloated spending hampered innovation and directly contributed to decades-long economic stagnation.

“Americans for Prosperity and Kansas Policy Institute believe government budget processes should focus on whether government programs are run effectively and efficiently. This means a year-round review of clearly defined and relevant measures that gauge how efficiently programs operate. Enforcing performance-based budgeting creates a continuous improvement process on par with firms in the private sector. This creates an opportunity to find processing errors, ensure that money is well-used, and create effective bipartisan collaboration.”