In its fifth straight decade of economic stagnation, Kansas fell further behind in the 4th Quarter of 2021. Private-sector wages and salaries didn’t keep up with inflation and grew much slower than the national average. The private-sector change in real (inflation-adjusted) GDP was about half that of several neighboring states.

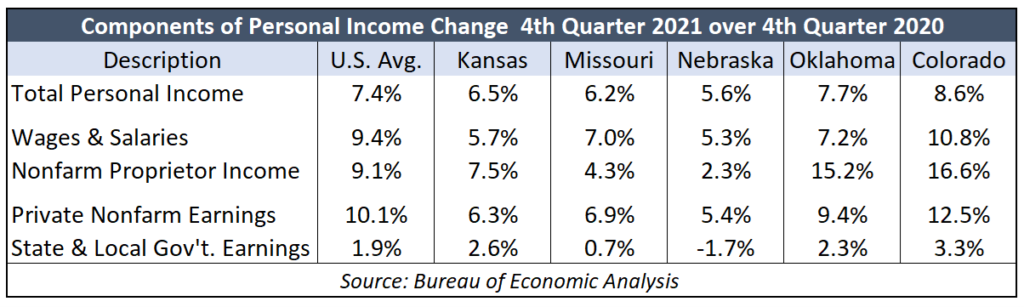

The Consumer Price Index of Midwest Cities jumped 7.2% in the 4th Quarter, but the Wage & Salary component of Personal Income increased only 5.7% in Kansas; the national increase was 9.4%. Kansas had the slowest growth among neighboring states except Nebraska, which rose 5.3%. Another component, Nonfarm Proprietor Income, also trailed the nation (7.5% vs. 9.1%); Oklahoma and Colorado had better growth, while Missouri and Nebraska were lower than Kansas.

Most of the Wage & Salary disparity for Kansas is likely due to anemic private-sector job growth for the 4th Quarter. The national average was a 4.8% increase year over year, but only 1.5% in the Sunflower State.

Total Personal Income includes government transfer payments and components not part of disposable income, like employer payments for insurance and retirement.

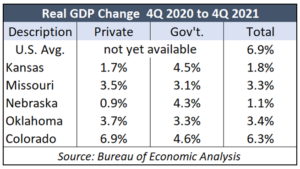

The 4th Quarter real GDP change follows a similar pattern, with Kansas far behind neighboring states except Nebraska.

Private-sector GDP growth was only 1.7% compared to the year prior, while it jumped 4.5% for state and local government. Nebraska’s growth was only 0.9%, but Missouri (3.5%), Oklahoma (3.7%), and Colorado (6.3%) outperformed Kansas.

Private-sector GDP growth was only 1.7% compared to the year prior, while it jumped 4.5% for state and local government. Nebraska’s growth was only 0.9%, but Missouri (3.5%), Oklahoma (3.7%), and Colorado (6.3%) outperformed Kansas.

The national comparison for private and government is not yet available, but total real GDP is estimated to have grown by 6.9%

High tax burden hurts economic activity

The Tax Foundation says Kansas has the second-highest state and local tax burden in the region, with only Nebraska worse. And it may not be a coincidence that Nebraska is the only state with slower economic growth.

The Sunflower State has the worst effective tax rates in the nation on mature businesses (Tax Foundation), and Kiplinger says Kansas is the third-worst state for retirees.

Bureau of Economic Analysis data compiled in Kansas Policy Institute’s 2021 Green Book shows superior economic performance for states with lower tax burdens. Between 1998 and 2019, the ten states with the lowest state and local burden (Tax Foundation) had a 51% increase in private-sector jobs, compared to just 29% for the ten states with the highest combined burden. The low-burden group also had much better GDP growth (163% vs. 142%).

Kansas Policy Institute owns The Sentinel.