The tax-and-spend ways of the Kansas legislature over the last three years has been a serious drag on private-sector GDP growth over the last three years. Real (inflation-adjusted) GDP data released last week by the Bureau of Economic Analysis shows private-sector growth of just 3.9% for the 3-year period ended September 20, 2019, and only 0.7% for the 12-month period ended the same date. Kansas is ranked #45 on both time frames. Only West Virginia, South Dakota, Iowa, Michigan, and Delaware posted lower growth over the last 12 months.

Private-sector GDP in neighboring states is growing faster than Kansas and three of them are considerably stronger. Missouri grew 7% over the 3-year period and 2.1% over the last 12 months, earning a rank of #24 in both cases. Oklahoma did even better, ranking #20 for the 3-year period and #13 over the last 12 months. Colorado has the best results, with 11.7% over the 3-year period and 3.5% over the last 12 months; Colorado ranks #6 and #7, respectively. Nebraska did slightly better than Kansas; ranking #43 and #27, respectively.

Private-sector GDP in neighboring states is growing faster than Kansas and three of them are considerably stronger. Missouri grew 7% over the 3-year period and 2.1% over the last 12 months, earning a rank of #24 in both cases. Oklahoma did even better, ranking #20 for the 3-year period and #13 over the last 12 months. Colorado has the best results, with 11.7% over the 3-year period and 3.5% over the last 12 months; Colorado ranks #6 and #7, respectively. Nebraska did slightly better than Kansas; ranking #43 and #27, respectively.

Government, however, is growing faster than private-sector GDP over the last 12 months; real GDP grew 0.8% and Kansas is ranked 12th nationally. Government growth of 1.5% over the last three years was ranked #26.

Substantial tax and spending growth

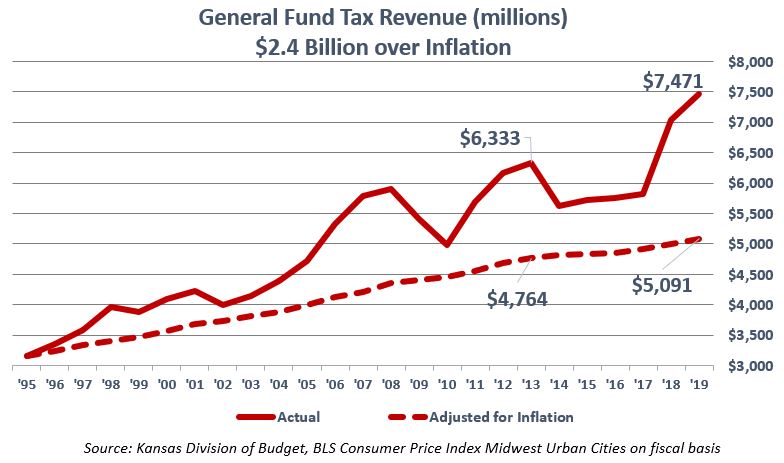

In 2017, the Legislature imposed a retroactive, double-digit income tax increase rolled out over two years. Last year, Governor Kelly vetoed legislation that would have prevented a third consecutive increase related to changes in the federal tax code. Those increases drove total tax revenue up by $1.6 billion in the last two fiscal years, for a 28% jump.

Democrats, some Republicans and Governor Kelly used their large tax hikes to explode state spending, which had already been at record levels. They added almost $1 billion to General Fund spending in FY 2018 and FY 2018 and the budget is expected to exceed $8 billion in FY 2023, mostly due to enormous school funding increases.

The $8.3 billion spending estimate would be a 32% jump since FY 2017 and does not include Medicaid expansion and other spending increases proposed by Governor Kelly.