The Senate Tax Committee heard testimony on Senate Bill 283, which sets a course for an eventual flat tax but ends the popular Kansas Commerce Department tax subsidies High-Performance Incentive Plan (HPIP), Promoting Employment Across Kansas (PEAK), and the Kansas Affordable Housing Tax Credit, among other incentive programs to attract and keep businesses in the state. It’s the halting of the tax credits that brought the overwhelming majority of witnesses to the committee to oppose the bill.

The legislation proposes a gradual decrease in the highest of the two current tax brackets in the state, 5.58% for joint filers earning over $46,000 yearly, until Fiscal Year 2028 when it will equal the lower bracket of 5.2%, and remain there, resulting in Kansas joining 14 other states with a flat tax.

But spokesmen for major manufacturers and real estate developers in the state argued that elimination of the tax credits would put businesses in Kansas at a competitive disadvantage in luring other economic development to The Sunflower State.

Tony Adams of Golden Waves Grain, a western Kansas milling company, spoke on the importance of HPIP, which provides a 10% tax credit that is eligible for capital investment of at least $50,000 at the company’s facility:

“GWG is currently investing $160 million to establish a state-of-the-art flour milling operation and commercial bakery in Goodland, Kansas. This facility is projected to create 141 quality jobs, significantly boosting the local economy. Our project has been recognized as a pivotal economic development initiative for Western Kansas, comparable in impact to the Panasonic project in Eastern Kansas. For the past 100 years, bread delivery has relied on an outdated system. GWG is revolutionizing the industry with a state-of-the-art facility and a cutting-edge delivery process that ensures fresher bread, greater efficiency, and a smarter supply chain.”

Mark Deuel, Chief Financial Officer for Orizon Aerostructures, touted by HPIP and PEAK, which refunds 95% of payroll taxes back to employers on qualified employees:

- Growing communities need good businesses that can create career opportunities, while the businesses need communities with good infrastructure (i.e., schools, hospitals, utilities, trainable workforce, etc.

- Resources to start and grow businesses are scarce, with very limited banking resources until proven

- Risk of industry problems (i.e., Aerospace, pandemic, etc.)

- Cost of building something unique (i.e., technology, training learning curve, etc.)

- Recruiting talent to relocate into communities can be difficult and costly

- Competition for new businesses is very competitive

- Orizon was approached by 49 communities when we started in 2016.

Those advocating for the housing tax credit promoted it as a key to solving a crisis in the amount of available, affordable housing in the state.

Dave Trabert, Chief Executive Office of Kansas Policy Institute, owner of The Sentinel, was the lone supporter of the measure to testify. He says broad-based tax cuts are preferable to subsidies for economic development:

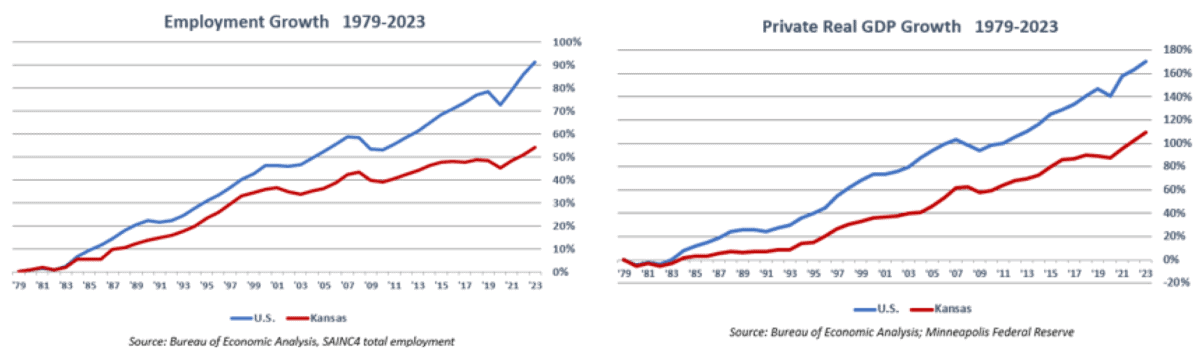

“Research from the Tax Foundation shows that income taxes are more damaging to the economy than any other type of tax. Corporate income taxes are the most harmful, followed by personal income taxes.

“A joint paper we published with The Buckeye Institute also found that reducing the corporate income tax rate would produce the most economic benefit for Kansas relative to any other tax cut.

“Subsidies or other government spending will not resolve the economic stagnation shown in the charts below. Kansas must address its very uncompetitive corporate tax climate.”

Tax Committee Chair Caryn Tyson was frustrated by some of the answers she received as she questioned opponents:

“I don’t like the government picking winners and losers with subsidies like these. We need broad-based tax cuts for all Kansans.”