After multiple vetoes, the Kansas Legislature believes “Groundhog Day” has ended, and Governor Laura Kelly says she will sign its latest offer of bipartisan tax reduction.

SB 1, negotiated among the governor, Senate President Ty Masterson, and House Speaker Dan Hawkins, which received some criticism during floor debate for a lack of transparency and legislative input, nonetheless passed overwhelmingly on the one-day Special Session. The Senate approved the measure 34-4; the House OK’d it 121-2. Among its provisions:

- A reduction from three to two income brackets. Joint filers with taxable incomes up to $46,000 will be taxed at 5.2 percent; above $46,000, 5.58 percent.

- Personal exemptions rise from $2,250 for all persons on the return, to $18,320 for married couples filing joint returns, $9,160 for all other filers, and an additional $2,320 for each dependent listed on the return. This change ensures that everyone gets a reduction.

- Exemption from taxation of all Social Security benefits.

- An increase in the standard deduction amount from $3,500 to $3,605 for single filers, $8,000 to $8,240 for married filing jointly, and $6,000 to $6,180 for head-of- household filing status beginning this year.

- The bill abolishes the Local Ad Valorem Tax Reduction (LAVTR) Fund and County and City Revenue Sharing Fund and eliminates statutory transfers from the State General Fund (SGF) to these funds.

- Residential property tax exemption from the 20 mills for schools will increase from$42,000 to $75,000.

- The tax credit for household and dependent care expenses increases to 50% from the current 25% of the federally allowed amount effective this year.

Sen. Caryn Tyson, Chair of the Senate Assessment and Taxation Committee, said the compromise plan is a good start:

“Kansans keeping more of their hard-earned money is always a win. Exempting Social Security from state income tax is something I’ve been leading the fight on for a few years. Lowering state income tax for all Kansans, especially families and those in need, is another win. The tax conferees were able to substantially increase personal exemptions, which lowers income taxes.

“Many of us fought for more of a reduction on property taxes, and I will continue that fight…it’s too important”

Not as complementary of the bill was State Director for Americans for Prosperity – Kansas, Liz Patton:

“This costly and unnecessary special session could have been avoided with Governor Kelly signing a bipartisan tax compromise bill weeks ago. This legislation now offers Kansans less tax reform than we could have delivered. The legislation passed is a step in the right direction, though more work remains to be done to cut income tax for Kansans who are already struggling in Biden’s economy.

“We look forward to working with policy champions next session to ensure comprehensive tax reform is delivered for hardworking families in our state.”

Tax cut is better than nothing, but won’t have much economic impact

Kansas Policy Institute CEO Dave Trabert testified that SB 1 is better than nothing, but the tiny rate reductions won’t make Kansas much more competitive. Trabert says personal and corporate income tax rates must be further reduced to break the state’s five-decade trend of economic stagnation. KPI owns The Sentinel.

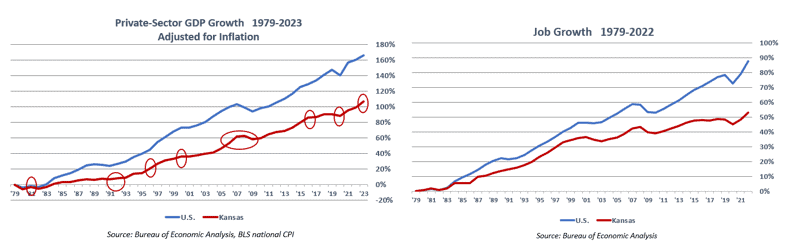

Kansas has trailed the national average on job growth and private-sector GDP since the late 70s, and the gap is getting wider.

The Sunflower State trailed the national average in inflation-adjusted economic output 31 times out of the last 44 years, with timing differences possibly accounting for most of the other 13 times as Kansas typically enters and exits recessionary times later than most states.

Trabert says Kansas will still have very high tax rates relative to other states.

No timetable was given for the governor’s decision on the legislation.