Taxpayers across Kansas are howling about double-digit valuation hikes on their homes, which some appraisers justify by an increase in the median sales price of homes sold. But tax attorney Linda Terrill with Property Tax Law Group says a change in median sales prices isn’t a valid reason to increase valuations on homes that weren’t sold, and data from the Miami County appraiser seems to make Terrill’s point.

The median sales price is determined by listing all prices in ascending or descending order and finding the midpoint – where half the homes sold for more, and half the homes sold for less. A change in the distribution of sales from one year to the next therefore can materially change the median regardless of market conditions. It’s just basic math.

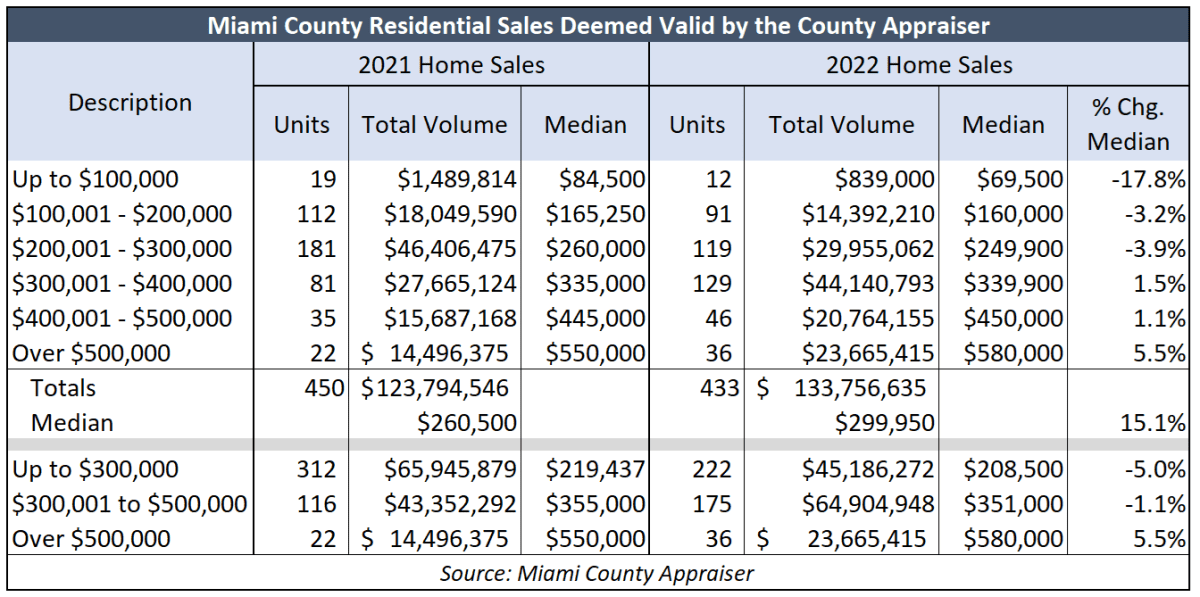

Miami County just sent valuation notices to property owners that reflect large increases across most classes of property, with residential values jumping more than 18%. The Sentinel obtained the list of what the appraiser deemed valid sales for 2021 and 2022, and there is a 15% increase in the median, but that change primarily results from there being fewer sales and a different ‘mix’ of sales values.

The number of sales and median prices declined in the first three tiers of sales value – up to $100,00, $100,001 to $200,000 and $200,001 to $300,000. The median sale for homes up to $100,000 dropped about 18% and the next two tiers dropped by at least 3%.

Conversely, sales in the next two tiers increased and the median rose a little more than 1%. Sales in excess of $500,000 also jumped more than 50% (from 22 sales to 36 sales) and the median sales price was 5.5% higher.

Appraiser Justin Eimers explains why the median values are used:

“A median average is used because it is a better indicator of central tendency. The mean average is more susceptible to outliers. Mass appraisers typically use median as it is a better indicator of what is going on with the typical property.

That’s not what the data shows, however. There is also another variable used by appraisers that impaacts median sales price – they choose which sales are valid and ignore the rest.

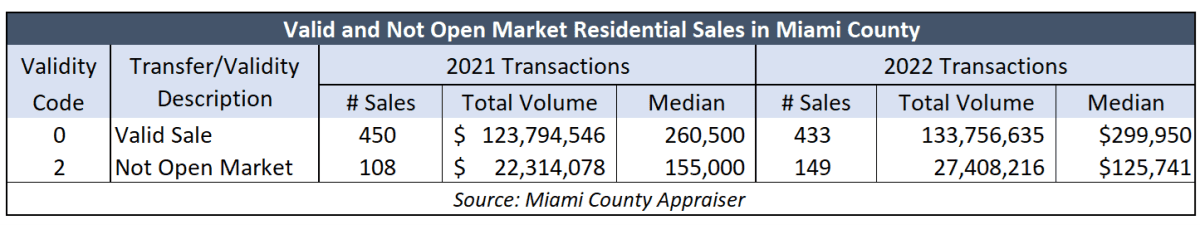

There were 761 residential sales in 2021 and 712 last year, but the appraiser only considered valid sales to be 450 and 433, respectively. Some sales were exclused for perhaps understandable reasons, like liquidations and foreclosures. The category of “not open market,” however, is assigned at the appraiser’s discretion and the median sale in that category dropped from $155,000 to about $126,000.

To demonstrate the impact of excluding sales considered not open market, we calculated the median sales price for both years by combining valid and those considered not open market. In that case, the median would only be 6% higher. An appraiser choosing to exclude sales as ‘not open market’ forced the median sales price to jump 15% instead of 6%.

Terrill says homeowners should not hesitate to appeal their appraisal and offered a lot of advice in this 15-minute interview. At least in Miami County, it seems homeowners have good reason to file appeals.