The Sentinel has been requesting sales tax data from the Kansas Department of Revenue (KDOR) to determine the effectiveness of the Derby STAR bond project for several months. Some information has been provided but KDOR refuses to directly answer questions about the net sales tax remaining for city and state operations after siphoning off sales tax for STAR bond debt service.

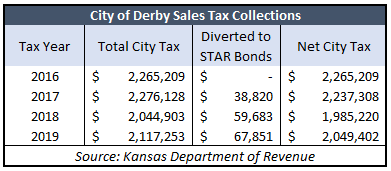

With that caveat, it appears that the City of Derby has about 10% less (roughly $217,000) available to operate the city than the year before the STAR bond project was constructed. KDOR provided total city sales tax collected and the amount that was diverted to pay a portion of the STAR bonds, but refuses to say whether the difference – shown in the adjacent table as Net City Tax – was the correct amount of sales tax available for city operations.

With that caveat, it appears that the City of Derby has about 10% less (roughly $217,000) available to operate the city than the year before the STAR bond project was constructed. KDOR provided total city sales tax collected and the amount that was diverted to pay a portion of the STAR bonds, but refuses to say whether the difference – shown in the adjacent table as Net City Tax – was the correct amount of sales tax available for city operations.

The Derby Dinosaur Park opened in 2018, on the theory that park attendance would drive new retail activity to the city. But attendance has been only been about a third of the estimate used to justify the STAR bond project, and the city saw retail activity decline in 2018; sales picked up a bit in 2019 but it remains lower than in recent years.

The vast majority of visitors to the STAR Bond project are shopping at national and regional retailers, most of which existed before the STAR Bond district was created. The argument in favor of STAR bonds is that they allow cities to build tourist attractions and use incremental sales tax revenue to pay off the debt.

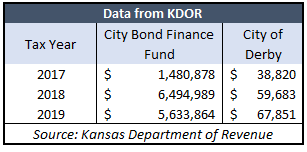

The Sentinel asked the KDOR to clarify if the sales tax numbers provided include any revenue that’s being used to pay off the STAR bonds. After months of stalling and being notified that a formal complaint may need to be filed with the Attorney General, KDOR provided the information in the adjacent table on tax dollars that were diverted from city and state coffers to go toward the STAR Bond fund.

The Sentinel asked the KDOR to clarify if the sales tax numbers provided include any revenue that’s being used to pay off the STAR bonds. After months of stalling and being notified that a formal complaint may need to be filed with the Attorney General, KDOR provided the information in the adjacent table on tax dollars that were diverted from city and state coffers to go toward the STAR Bond fund.

KDOR spokesperson Sarah Fulton said of the data, “In response to your subsequent question of whether the sales tax numbers provided include any revenue that’s being used to pay off the STAR bonds, the following amounts were transferred from 2017 – 2019 to the State’s City Bond Finance Fund and the city of Derby for bond repayment.”

We asked the question again, seeking a simple ‘yes’ or ‘no’ response, to which Fulton replied, “…there is no easy yes or no. The money not going to the STAR bond doesn’t all go to general operations. A portion of the state money goes to the general fund and a portion goes to the highway fund. Also, as previously indicated, our statutory obligation is to collect the money and distribute it to the city. KDOR does not collect city budgetary information, so any questions regarding city expenditures need to be addressed directly to the city.”

So far, $13.6 million has been diverted from the State General Fund for the state’s share of sales tax used to pay off STAR bond debt – for a horribly under-performing dinosaur park.