It is an article of faith among superintendents, teacher unions, and the Kansas Association of School Boards that education — particularly special education — in the state of Kansas is woefully underfunded.

Indeed, they all repeatedly hounded the Kansas Legislature for more special education funding last session, saying regular education services were curtailed because they had to transfer funding to special education.

That their own budgets refuted that statement was irrelevant.

Now, an article by Kansas Policy Institute CEO Dave Trabert shows that the districts’ reported cash fund balances refute it as well. The Sentinel is owned by KPI.

The total special education cash reserve balance was $273.6 million at the end of the 2024 school year, which is an increase of $18.6 million over the prior year, leading to two vital takeaways:

- School administrators transferred $18.6 million more than needed to maintain special education cash reserves and,

- School administrators are holding too much money in special education cash reserves. Many districts maintain very low balances (seven have a zero balance).

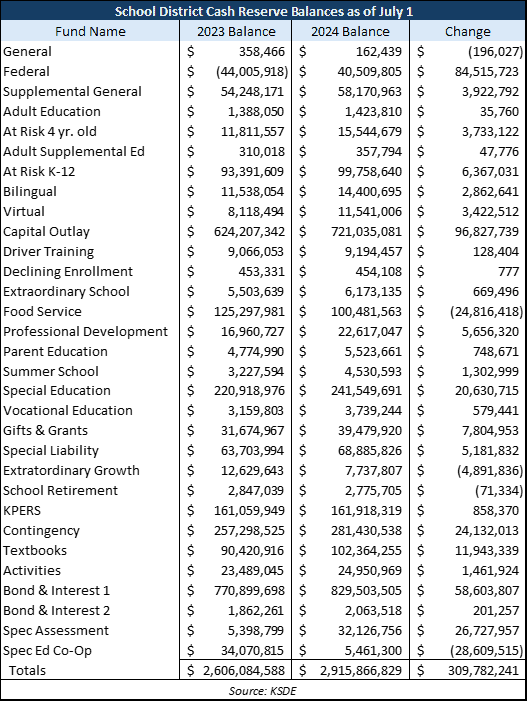

Operating cash reserves, including special education, are $1.317 billion. The increase of more than $60 million from the previous year means administrators didn’t spend all the money they collected to educate students in the last school year. Total cash reserves (operating reserves, plus federal reserves and cash held for capital outlay and debt repayment) exceed $2.9 billion.

Since 2005, school districts have increased operating cash reserves by nearly $850 million. Balances for each school district are available at KansasOpenGov.org.

As the adjacent table shows, school districts often have more than 30 “fund balances.”

These “funds” are similar to having 30 separate checking accounts in which funds for various programs are held.

“There might be checkbooks for home maintenance, food, education expenses, auto expenses, etc. Your paycheck is deposited into a general fund checking account (maybe for non-specified costs), and then you transfer money to the other accounts,” Trabert wrote. “Some fund balances can only be spent for specified purposes, like special education. Other funds are unrestricted, meaning the money in them can be spent for anything allowed by law, and balances in those funds can be transferred to other funds.”

Additionally, according to the Kansas Department of Education, an actual balance in a particular fund is not necessary to spend money from that fund — although the money must exist somewhere.

“Let’s say a district keeps a zero balance in a restricted fund (like Special Education) and has $10 million in other operating funds at the beginning of the year,” Trabert wrote. “The district spends $1 million during the year in that restricted fund and transfers $1 million from another fund, finishing the year with a zero balance in the restricted fund.

“Smart cash management prevents money from becoming trapped in restricted funds and allows districts to have less money in reserve.”

The bottom line, Trabert says?

School administrators want more money, but they don’t actually need it.

“School administrators continually demonstrate that they have plenty of money to educate students; they may not be spending it effectively, but the money is there,” Trabert wrote, adding that administrators are also quite aware the Kansas Supreme Court approved the Legislature’s plan to fund schools, including specific increases in special education that have been provided each year.

“Unfortunately, the Legislature didn’t remove a statutory reference to special education funding that conflicts with the school funding settlement, and education administrators are using that to demand even more money from taxpayers,” Trabert wrote. “Taxpayers already provide more than $18,000 per student, which is more than adequate.”