Hawver’s Capitol Report, a subscription-only digital publication, called a fiscal note presented last week to the Kansas House Tax Committee “sketchy.” The fiscal note from the Kansas Department of Revenue indicated revenues would increase only $50 million once farmers and other small business owners had their LCC-tax exemptions revoked.

Martin Hawver wrote: “..Williams presented the sketchy new fiscal note.”

Hawver didn’t, however, reveal which parts of the fiscal note are “sketchy,” though he noted that a previous fiscal note, which estimated smaller revenue gains if the LLC-exemption is revoked, “could have dampened enthusiasm for putting LLCs back in the tax code.”

Perhaps smaller than hoped returns translate into “sketchy?”

The note Sam Williams, acting revenue secretary, presented takes into consideration that small business owners will take tax deductions they aren’t currently taking if the LLC exemption is revoked.

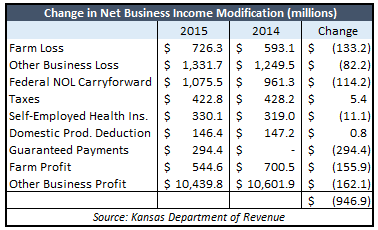

Hawver fails to mention that the Kansas Department of Revenue data for 2015 revealed that Sunflower State pass-through businesses had $1 billion less taxable income in 2015, much of the loss was attributable to oil and farming. Farming alone accounted for $289 million and the new tax of guaranteed payments to pass-through owners also reduced taxable income by $294 million. That may be the reason the “sketchy” fiscal notes aren’t as high as some would like.