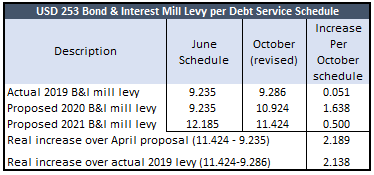

USD 253 officials told the Emporia Gazette the incremental cost of the proposed Emporia school bond issue is now just a half a mill in the property tax rate due to lower interest rates. But  the real increase is over 2 mills because the district didn’t disclose a 1.6 mill increase implemented this year.

the real increase is over 2 mills because the district didn’t disclose a 1.6 mill increase implemented this year.

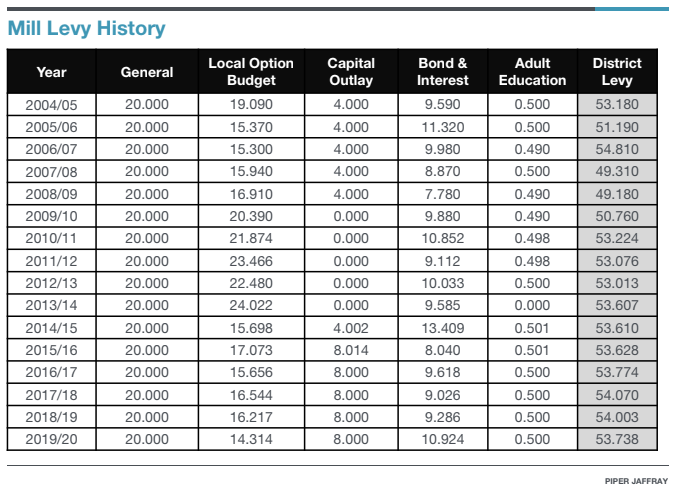

The district’s claim of a half-mill increase is based on going from 10.924 mills this year to a proposed rate of 11.424 mills if the bond issue passes. But the district’s Power Point presentation said the existing rate for 2019 base year was 9.24 mills and both the original debt service schedule and the Mill Levy History report said it was 9.286 mills; The debt service schedule listed the 2020 mill rate unchanged at 9.286 but the Mill Levy History report didn’t show 2020 information.

The updated Mill Levy Report, however, shows the district increased the levy this year by 1.638 mills, to 10.924. At a minimum, then, the proposed bond issue would result in a 2.138 mill increase – the difference between the now-proposed rate of 11.424 and the actual rate of 9.286 mills for the 2019 school year.

The existing 10.924 mills of property tax for current bonds expire in two years, so if the new bond issue fails, taxpayers would have their mill rate reduced by that amount and also not have to pay the now-proposed 0.5 mill increase. The real property tax cost of the proposed bond is 11.424 mills.

The revised total cost of the Emporia school bond project including interest is now $134.3 million.

USD 253 won’t respond to questions

The Sentinel contacted USD 253 two days ago to ask, among other things, why the district increased the Bond & Interest rate to 10.924 mills this year, but the district hadn’t responded to our questions at press time.