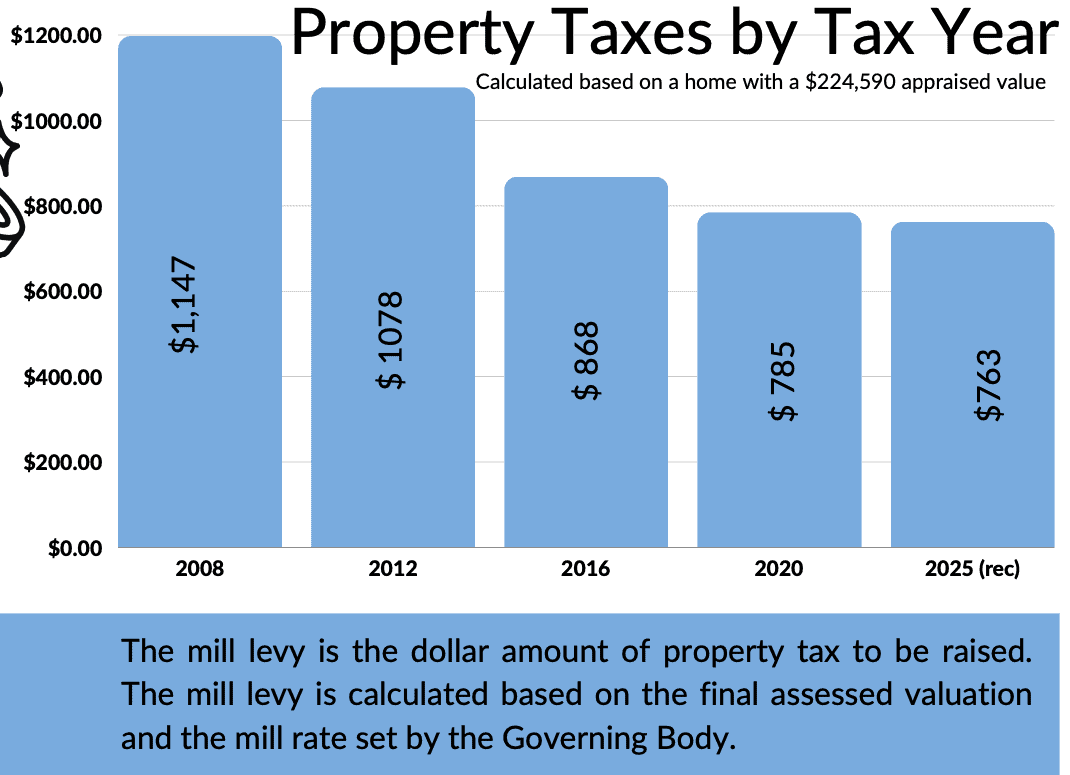

The City of Edgerton claims property taxes have declined for the average homeowner since 2008. That’s the message to residents in this graphic produced by the city:

When The Sentinel questioned the city’s calculations in an era of rising property values resulting in increasing property taxes regardless of the fluctuation of mill levies, we received this response from Assistant City Manager Kara Banks:

“Your analysis and calculation in the email is incorrect. The correct math is as follows.

City of Edgerton 2013 mill rate: 36.935

City of Edgerton proposed 2025 mill rate: 29.550

$224,590 (appraised value) x 11.5% = $25,828 (assessed value)

2013: $25,828 x 0.036935 = $953.96 in Edgerton taxes

2025: $25,828 x 0.029550 = $763.22 in Edgerton taxes

This equals a DECREASE of $190.74. A decrease of nearly 20% in 12 years.

Edgerton claim is refuted by the data

City Councilman Ron Conus counters the city’s math with his own example:

“I think you know how deceiving this is…showing property taxes at their lowest level ever when in fact, they are at the highest.

“The fallacy of their math is that a home which is worth $224,590 today was not worth that value 12 years ago.

“Let me do the math with my home as a real example:

(From) 2012 (to) 2025, My appraised value (went from) $135,100 (to) $260,600. My assessed value (went from) $15,536 (to) $29,969 (at 11.5% of appraised value). Mill rate (went from) 36.935 (to) 29.55. Edgerton taxes went from) $573.82 (to) $885.58. My property taxes have not declined 20%; they are 54% higher.”

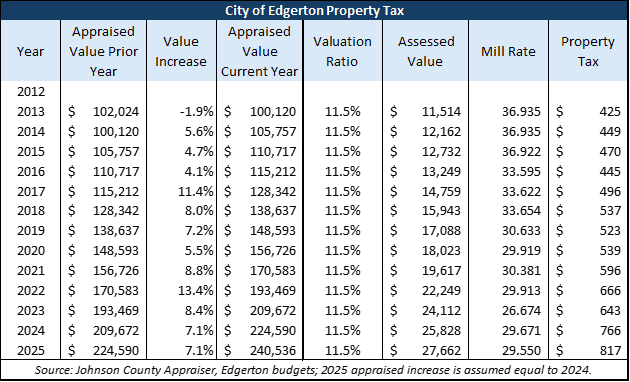

Data from the Johnson County Appraiser’s office also refutes Banks’ claim.

The average home value in 2013 was $100,120; the mill rate of 36.935 would have resulted in $425 in property tax. In 2024, the tax on the average home value is 80% higher, at $766.

The appraised value of the average home in Edgerton jumped 7.1% in 2024. If the same increase occurs in 2025, the proposed mill rate of 29.550 would result in a 7% property tax increase on the average home of $817.

The same is true for the owner of a home valued at $224,950 in 2013. The tax then would have been $955; with the average annual valuation increase, that property today would be appraised at $504,614 and the tax would be 80% at $1,722.

Kansas Policy Institute CEO Dave Trabert says Edgerton’s attempt to mislead property owners is another example of government officials not being honest with taxpayers.

“The Truth in Taxation / Revenue-Neutral Act passed in 2021 with overwhelming bi-partisan support because taxpayers were fed up with local officials claiming to ‘hold the line’ while imposing large tax increases. The City of Edgerton’s ongoing attempt to mislead shows the Legislature has more work to do to, possibly with a constitutional amendment to limit the dollar amount of tax increase that can be imposed without voter approval.”