A new study by the Sentinel’s parent company, Kansas Policy Institute, shows massive differences in county government spending per resident across the state.

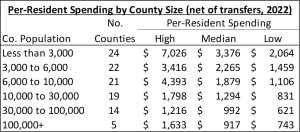

KPI analyzed the per-resident spending in all 105 counties, grouping them by population to mitigate economies of scale. In each population grouping, some counties spent two to four times as much as others.

For instance, Johnson County — the most populous in the state — with a population of approximately 619,000 spends $1,633 per resident. However, Sedgwick County — roughly the same size — with 525,525 residents spends less than half that amount at $743 per person.

Going down the scale to midsized counties, Cowley County, with $34,453 people, spends just $621 per resident, while Crawford County, with a bit over 39,000 in population, spends $827 per resident. County spending per resident for each county is available at KansasOpenGov.org.

The variance in spending per resident demonstrates that many counties could operate more efficiently and reduce property taxes.

“Spending matters for several reasons,” the report reads. “Most directly, the amount a county spends determines how much it taxes. For instance, between 1997 and 2023, Wyandotte County’s population increased by 8.2%, and inflation was 80.4%, see adjacent graph. However, the property tax paid by Wyandotte County residents ballooned by 301.2%. That difference between the increases in property tax and inflation and population growth was driven by choices in how much the county spent.”

This is particularly notable in property taxes between similarly sized cities across the country.

For example, a $150,000 rural homestead in Iola, Kansas, has the fourth highest property tax compared to similarly sized towns in the rest of the states. The Iola homeowner pays $3,313 (Lincoln Institute of Land Policy, taxes payable 2022), whereas the tax on the same value home in Moorehaven, Florida, is $2,182. The tax is just $1,765 in Stockton, Texas, and only $841 in Savannah, Tennessee.

Counties don’t have to slash services to reduce spending per resident

According to the report, counties don’t necessarily have to cut services or programs to reduce spending.

“Cutting spending shouldn’t be a measure of hacking and slashing away programs from the budget, but rather a continuous effort to identify waste or reduce budgets,” the report reads. “At the national level, the Government Accountability Office (GAO) has thousands of recommendations made across both Democratic and Republican administrations on how to reduce costs.”

KPI suggests county and state officials would be well served to use “performance-based budgeting, which requires agencies — or county departments — to identify goals for their programs and report on their progress, or lack thereof, with an aim to drive appropriation decisions. Several simple reforms done across a county would almost certainly add up in savings for taxpayers quickly.

Ultimately, Kansas has the 3rd highest number of general purpose governments per resident in the country: that is, for every 1,475 of Kansas’s 2.9 million residents, there’s a city, county, or township taxing and spending them. After Wyoming, Kansas has the second-highest number of local government employees per resident in the country. Kansans are massively overgoverned – and as a result, face higher taxes.