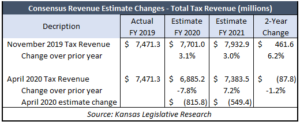

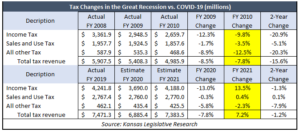

The Consensus Revenue Estimate (CRE) released Monday predicts a very modest two-year decline of just $88 million for the State of Kansas, but the real impact is likely many times worse. An analysis by Kansas Policy Institute, which owns the Sentinel, shows Kansas tax revenue plummeted by $922 million over two years during the 2009-10 period of the Great Recession.

Media reports and CRE typically only talk about changes to revenue estimates in terms of changes to previous expectations. In this case, CRE reduced official tax revenue estimates by about $1.3 billion over two years, but they didn’t talk about comparisons to prior year actual collections.

Media reports and CRE typically only talk about changes to revenue estimates in terms of changes to previous expectations. In this case, CRE reduced official tax revenue estimates by about $1.3 billion over two years, but they didn’t talk about comparisons to prior year actual collections.

The adjacent table shows that instead of a 6.2% tax increase over two years – FY 2019 to FY 2021 – the estimators predict a 1.2% decline of about $88 million. They predict a 7.8% decline this year (ending June 30) and a 7.2% increase for the year starting July 1.

Compared to the Great Recession, the government estimators see the COVID-19 impact as a rather mild event. The first year is similar (down 8.5% between 2008 and 2010, vs. 7.5% this year. But they say tax revenue will increase next year by 7.2% even though it dropped by 7.8% in 2010.

Most national experts believe COVID-19 will create a much greater fiscal shock than the Great Recession. Michael Austin, director of the KPI’s Center for Entrepreneurial Government, believes the CRE estimate is far removed from reality because the estimators have a relatively rosy view of the COVID impact.

“Whenever the Consensus group presents their tax predictions, the smell test for a quality projection is whether it mirrors national expectations. If the answer is no, then you probably have a really flawed projection. The Kansas consensus group’s COVID economic impact is so off the mark they should seriously consider providing another estimate.“

Kansas Legislative Research says the estimators think real GDP will decline by 4.7% this year in Kansas and by 4.5% nationwide. By comparison, Goldman Sachs expects a 6.2% drop for the United States and Morgan Stanley calls for a 5.5% decline. To make matters worse, Kansas has been trailing the nation on GDP growth.

Austin says taxpayers, legislators, and agency officials better buckle up.

“If the state adjusts the budget based on their current estimates, Kansas taxpayers could be on the hook for higher taxes, or a meat cleaver will be taken to essential government services.“