Senate Bill 294, co-sponsored by 15 state senators, would require city and county elected officials to vote on the entire property tax increase in their budgets each year. The bill is scheduled for a hearing in the Senate Assessment and Taxation Committee next week.

Committee Chairwoman Caryn Tyson (R- Parker) says SB 294 doesn’t limit spending and elected officials don’t have to get public approval. They just have to vote on the entire tax increase they impose each year.

“Some city and county officials say they’re ‘holding the line’ on property taxes, but voters know that property tax has been rapidly increasing because of valuation changes. That frustrates taxpayers,” says Tyson.

Once a city or county gets new valuation totals each year, a ‘Certified Rate’ is calculated to produce the same property tax revenue as the prior year based on the new valuations. Any increase in the certified tax rate would then need to be voted on by ordinance or resolution, with requirements for public hearings and by mailing notices to every taxpayer in the taxing district 10 days prior to the hearing.

Currently, city and county officials just vote to approve their budgets, and then the county clerk calculates the mill rate needed to meet the budget. A mill is equal to $1 per $1,000 of assessed value.

Just having to vote on their budget allows local government officials to claim to be “holding the line on taxes” but taxes can still go up because of valuation changes.

One of the bill’s co-sponsors, Senator Richard Hilderbrand (R-Baxter Springs), says it would close the “honesty gap” on property taxes.

Johnson County increased property tax by 244% between 1997 and 2018, according to the Kansas Department of Revenue; the mill rate went up 20%. That huge, 220-point difference between the actual tax increase and the change in the mill rate has created an ‘honesty gap’ in taxpayers’ minds.

The mill levy in Sedgwick County went down 3 percent, but tax revenues increased 103%, creating an honesty gap of 105%.

In Mitchell County, where Beloit is located, over the same time period, the mill rate increased 120% but taxes jumped 402%, leaving an honesty gap of 282%. Crawford County, located in perpetually impoverished southeast Kansas, increased the mill rate by 34% over that time frame but property taxes went up by 135%, resulting in a 101% honesty gap.

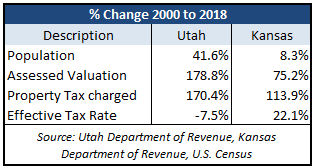

Senate Bill 294 is modeled after the Utah legislation that has successfully reduced property tax rates. Testimony submitted to the Senate Commerce Committee this week by Dave Trabert, CEO of the Sentinel’s owner, Kansas Policy Institute, says, “The effective tax rate in Utah declined by 7.5% between 2000 and 2018, according to their Property Tax Annual Statistical Reports. At the same time, the effective tax rate in Kansas increased by more than 22%. Utah’s property tax charged, however, increased by 170% because valuations increased by almost 179%. By comparison, Kansas increases were 114% and 75%, respectively.

Senate Bill 294 is modeled after the Utah legislation that has successfully reduced property tax rates. Testimony submitted to the Senate Commerce Committee this week by Dave Trabert, CEO of the Sentinel’s owner, Kansas Policy Institute, says, “The effective tax rate in Utah declined by 7.5% between 2000 and 2018, according to their Property Tax Annual Statistical Reports. At the same time, the effective tax rate in Kansas increased by more than 22%. Utah’s property tax charged, however, increased by 170% because valuations increased by almost 179%. By comparison, Kansas increases were 114% and 75%, respectively.

“Valuations in Utah increased more because the state is growing rapidly, having almost 42% population growth compared to just 8% in Kansas. Utah successfully reduced the effective tax rate, but the rate likely would have declined even more if new construction values were included in the calculations. Kansas Senate Bill 294 is modeled after the Utah legislation, but the co-sponsors improved upon it and include new construction in the calculation of the Certified Rate. If passed, city and county elected officials would then have to vote on the entire tax increase they impose each year.”

Government officials oppose the transparency bill

Hildebrand says the goal of the bill is transparency.

“SB294 is all about transparency and providing the citizens of Kansas more clarity in their property taxes,” he said. “This will allow Kansans the opportunity to provide input to their elected officials on the two things that cause their property taxes to increase; property valuations and mill levies.

“This will also provide more accountability on elected officials that set the mill levies and spending.”

But elected officials in Cherokee County, at least, are opposed.

County Commissioners Myra Fraizer and Neal Anderson both said they would not be in favor of the bill.

Fraizer said that, while she thinks more transparency in taxation is always a good thing, she was opposed to the written notification requirements.

“It’s a good thing to keep taxpayers informed,” she said. “But they’ve got to want to be informed.”

Frazier said there is plenty of opportunity during the budget process for taxpayers to express their opinion.

“Most taxpayers don’t think anything about the cost of their government until they get their tax bill,” she said. “And then it’s too late.”

Cherokee County Commission meetings, and thus public budget hearings, are during regular working hours on Mondays.

Anderson said he wasn’t sure what to think about the bill, as “there’s not much there we’re not already doing.”

However, he said, with the sale of a major employer Ortho-Four States Hospital to Mercy Health Systems — a non-profit — Cherokee County will be losing $26 million in valuation.

Anderson said that means a loss of about $400,000 to the county, another nearly $500,000 in tax revenues to the Galena school district and over $500,000 to the city of Galena.

“The only way to offset that is to raise taxes, and then we run into the tax lid,” Anderson said.

The tax lid referenced by Anderson doesn’t prohibit cities and counties from raising taxes; it merely requires them to get voter approval if taxes would increase beyond a certain level.

Anderson dismissed suggestions to cut spending.

“We’re under so many constraints now it’s hard to finance a budget,” he said, adding “This just looks like more hoops to jump through.”

Overwhelming voter support

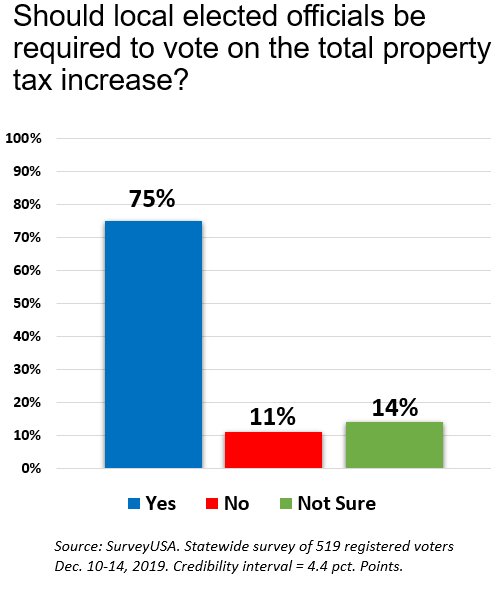

Local elected officials may not like having to be transparent and vote on their entire property tax increase, but voters overwhelmingly love it.

A December 2019 public opinion survey conducted by SurveyUSA on behalf of KPI asked whether local elected officials should be required to vote on the total property tax increase. Seventy-five percent said ‘yes,’ and only 11% said ‘no.’

A December 2019 public opinion survey conducted by SurveyUSA on behalf of KPI asked whether local elected officials should be required to vote on the total property tax increase. Seventy-five percent said ‘yes,’ and only 11% said ‘no.’

Support crosses all ideological and geographical lines. Seventy-three percent of self-described liberals and moderates and 80% of conservatives favor the change. Geographic support across the four regions (Western, Eastern, Wichita area, and Kansas City area) ranges from 72% to 78%.