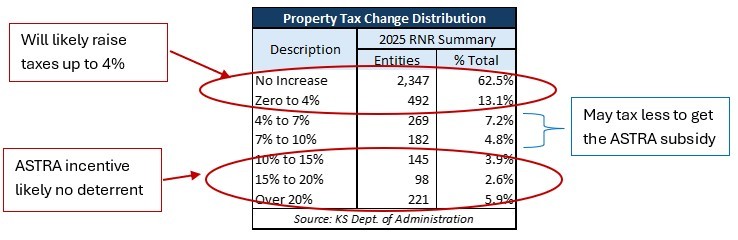

More than 2,300 local governments are not raising property taxes this year, and almost 500 more are raising taxes by less than 4%. However, they will all likely impose at least a 4% tax increase next year if revenue-neutral goes away, as the Kansas House of Representatives is trying to do with House Substitute for SB 35. Governments that don’t increase taxes more than inflation plus taxes from new construction, remodeling, and some debt service will receive a state subsidy from the new $60 million ASTRA fund.

The cost to taxpayers is about $61 million if they all go up to a 4% increase. What’s more, most of them will receive an ASTRA subsidy from the State, which will cost taxpayers millions more. Those already imposing double-digit increases will likely be unaffected by the subsidy carrot because it is less than they can get with a tax increase. Only a relatively small number of governments – those raising taxes this year between 4% and 10% – are most likely to change their taxing behavior because of the ASTRA subsidy.

SB 35, as passed by the Senate, would reduce property tax next year by about $80 million. The House stripped that provision, so that tax cut is off the table for now, putting the total effect on taxpayers at $141 million.

Removing revenue-neutral helps governments at taxpayers’ expense

For legislators, this boils down to deciding whether to help local governments or taxpayers. The only reason to repeal revenue-neutral is to give local governments a break; they’ve been asking for repeal and to reinstate LAVTR for three years…and that is what H Sub SB 35 does.

For legislators, this boils down to deciding whether to help local governments or taxpayers. The only reason to repeal revenue-neutral is to give local governments a break; they’ve been asking for repeal and to reinstate LAVTR for three years…and that is what H Sub SB 35 does.

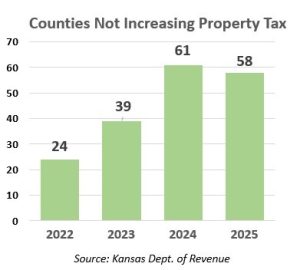

Some House members say they want to repeal revenue-neutral because it “isn’t working,” but the data shows otherwise. Here is another example: the adjacent table shows that 24 counties did not exceed revenue-neutral in 2022. The number jumped to 39 in 2023 and then 61 in 2024. With some county data still not available, there are already 58 counties not raising taxes this year. (These numbers include counties with increases less than one-half of a percent, which can occur because final valuations often change from the preliminary values upon which revenue-neutral is based.)

This all goes away if revenue-neutral is repealed.

Revenue-neutral is doing as intended: restraining the rate of increase. Without it, 2,800 local governments holding revenue-neutral or imposing increases less than 4% this year would be taxing more.